What Is The Procure-to-Pay Process?

In simple terms, the Procure-to-Pay process is how an organization purchases the raw materials and services needed to do business. For most businesses, defining the process begins long before making individual transactions.

Are you a procurement professional looking to make the most of your company’s purchasing and payments when pursuing an optimal return on investment (ROI)? If so, you need a well-developed Procure-to-Pay (P2P) process—the approach an organization uses to purchase the goods and services needed for doing business. Also known as the purchase-to-pay process, it brings together the procurement function with the accounts payable department. This process is foundational to the financial health and overall competitive strength of a business—especially those seeking to build value while reducing costs. For companies of all sizes, defining the P2P process is essential to, and begins long before, making transactions.

Every retailer, manufacturer, or service provider needs an efficient method to manage purchasing, cash flow, build vendor relationships, and maximize buying power. One of the most practical and powerful ways to optimize the P2P process (and build a better bottom line) is through the development of a strong procurement plan, supported by a Procure-to-Pay software system.

The Procurement Plan

Prior to making transactions, every business should have a procurement plan in place to define purchasing—and strong support from accounts payable to ensure prompt, cost-effective payments for the goods and services acquired. The plan should include detailed identification and pricing information for the goods and services needed. Each department, as well as each category of goods and services, receives a detailed budget, timeline, and preferred terms. Optimally, goods arrive when they are needed and not before, to minimize costly storage and maintenance.

The procurement plan outlines the process of obtaining goods and services, with contingencies that will help prevent delays, production shutdowns, or needless waste. Some materials can be well defined and automatically ordered when a threshold is reached; for example, when a construction company is building a house, a new order of wood screws can be automatically triggered when supply reaches a specified low.

For other items, buyers will need to submit a requisition order for approval. The procurement plan defines the purchase order approval process for each type of requisition, and establishes workflows to minimize delays, waste, and inefficiencies. For example, with an automated procurement solution like PurchaseControl, the system sends automatic alerts to approvers when a requisition is filed, and the document can be automatically routed to the next approver (or alerts sent to others) if the requisition is delayed for any reason.

The procurement plan is also used to establish a list of both standard and preferred vendors. Suppliers offering the best price, quality, and most reliable service are designated as preferred, while those with less stellar performance histories serve as second-tier or contingency vendors. By mapping out a supply chain, including contingencies, that also details the best possible vendor for each category, procurement teams insulate their companies against delays and disasters.

“Every retailer, manufacturer, or service provider needs an efficient method to manage purchasing, cash flow, build vendor relationships, and maximize buying power.”

Procurement Process Functions And Responsibilities

With a procurement plan in place, the supply chain issues are minimized, and so is the work to maintain deliveries. Terms are already negotiated with vendors, a master price list is on file, and protocols are defined. But before diving into the particulars of the P2P process, it’s important to develop or deepen one’s understanding of how procurement works in tandem with its partner, the accounts payable department, to organize and execute all phases of the procure-to-pay process.

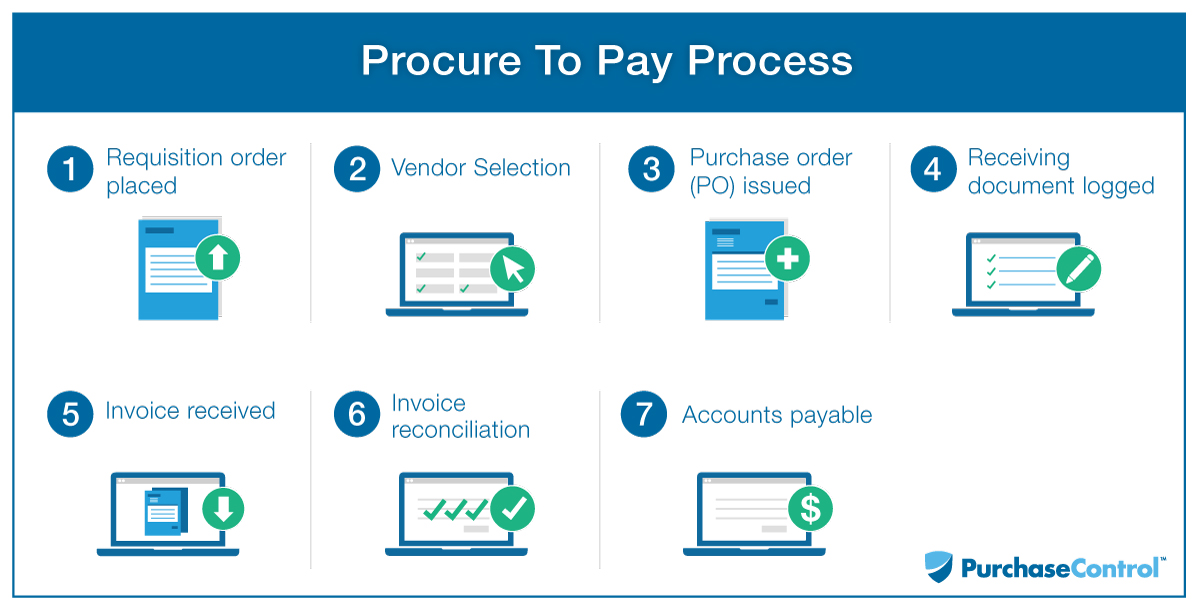

Procure-to-Pay Process Flow

While it may originate in procurement, the procure-to-pay process is also integral to, and an essential part of, the accounts payable process. From the original PO to the payment of the final invoice, both procurement and accounts payable team members have a vested interest in ensuring every process is well-optimized for savings, efficiency, and building value.

In fact, the P2P process itself can be broken into three primary phases, set in a repeating loop that, ideally speaking, improves with every iteration:

- The Purchase Order Process, during which:

- Purchase requisitions are created and approved.

- Vendors are evaluated and selected.

- Purchase orders are issued for the required goods and services.

- The Receiving Process, during which:

- Goods and services are received or executed.

- For goods, receiving documents are reviewed and logged.

- The Invoice Approval Process, during which:

- Invoices are received.

- Invoices are reconciled and cross-checked with the original PO and receiving documents (three-way matching).

- Errors are recorded and corrected.

- Approved invoices are paid.

Having explored the connection between the primary phases, let’s take a closer look at the P2P process, start to finish:

Procure-to-Pay Flowchart

Requisition Order Placed

Requisition orders are a formal request for goods or services. In cases where every item can be defined in advance, most requisitions are defined and built in to the procurement plan. Even the most carefully defined plans, however, can need additional materials due to spoilage, unforeseen events, scope creep from clients, or new ideas to make improvements on the original plan. Well-crafted procurement plan budgets have a cushion built in for just such circumstances, and requisition orders can be submitted later in the process if necessary.

Vendor Selection

For new orders, the vendor selection process may need to be brought into play. Working from a short list of vendors, the procurement department sends a request for proposal (RFP) outlining the requirements.

Suppliers return a bid on the job, detailing turnaround time, price, and pertinent material specifications.

During the process of choosing suppliers, negotiations take place. In addition to quality, cost and delivery schedules, the procurement department will explore potential advantages such as:

- Year-over-year price reduction

- Quantity discounts

- Future improvement in quality

- Freight and insurance costs

Compliance requirements must also be considered. The industry may have federal standards to meet, and the company may have a social conscious agenda endemic to company culture.

Corporate social responsibility is a rising concern among consumers, and businesses are expected to meet certain standards of sourcing in order to please their customer base—and avoid needless risk exposure. For example, many companies have committed to fair labor and environmental standards vendors must be able to meet to avoid consumer backlash.

Once negotiations with all the short-listed vendors are completed and the most advantageous deal is identified, a supplier is chosen according to the selection criteria outlined in the procurement plan and a purchase order is issued.

Purchase Order (PO) Issued

Once the requisition order is approved, a detailed order form with amounts and delivery requirements is submitted. The PO is sent to the appropriate vendor for fulfillment.

Receiving Documents Logged

The vendor delivers the goods or services and the relevant receiving document is entered, with line items verified to ensure that everything ordered is delivered.

Invoice Received

The vendor submits an invoice, which is entered into the system. Automated systems often support electronic invoicing (eInvoicing) through the use of vendor portals.

Invoice Reconciliation

The invoice is reconciled against the PO and relevant documents from the receiving process. In automated systems, the three-way matching process compares the purchase order and receiving document with the invoice to confirm that the goods were delivered as ordered and billed accordingly. Line items that do not match are flagged and reported for investigation.

Accounts Payable

Invoices approved for payment are routed to AP. Payments are made, and the accounting system is updated.

Maintaining an Efficient Procure-to-Pay System

During the course of a project or calendar period, many things can change, and keeping the P2P system in optimal working order requires attention to detail. Ideally, the procurement and accounts payable teams maintain constant contact with vendors, fostering good working relationships that inspire vendors to negotiate in good faith with customers who pay their bills on time and fulfill their commitments.

Anything from natural disasters to political events can cause raw material prices to rise or fall, affecting every link in the supply chain. This makes both supply chain management and supplier relationship management as high a priority as process efficiency and data management for procurement and AP professionals who want to achieve truly strategic sourcing while keeping costs low across the entire purchasing process.

Ultimately, however, the true benefit of a comprehensive procure-to-pay solution lies in its ability to foster open communication and create total transactional transparency between the procurement and accounts payable departments. For example:

- Centralized data management, automatic routing, alerts, and contingencies streamline the purchase order and invoicing cycles, ensuring automatic three-way matching.

- Integration with your existing enterprise resource planning system (ERP system) and accounting software brings all your data together in one place for leveled, mobile-friendly access for all stakeholders.

- Artificial intelligence and process automation eliminate human error, speed workflows, and free staff to focus their time and talent on high-value tasks while retaining the ability to investigate and correct issues as needed.

- Vendor management is vastly improved through:

- Total data transparency, real-time reporting, and centralized contract management.

- A closed buying environment that locks out maverick spend, invoice fraud, duplicate/late payments, and late fees while allowing for the capture of more early-payment discounts.

- Cultivation of enduring and strategic supplier relationships that allow businesses to forge powerful partnerships with their best suppliers while trimming bloat from their supply chain by eliminating under-performers.

When both of the key players have the tools they need to analyze and optimize spend, vendor management, and workflow efficiency, they can forge a P2P process that is truly a source of both savings and value for their organizations.

PurchaseControl Helps You Manage and Automate Your Procure-to-Pay Process with Ease

Find Out How