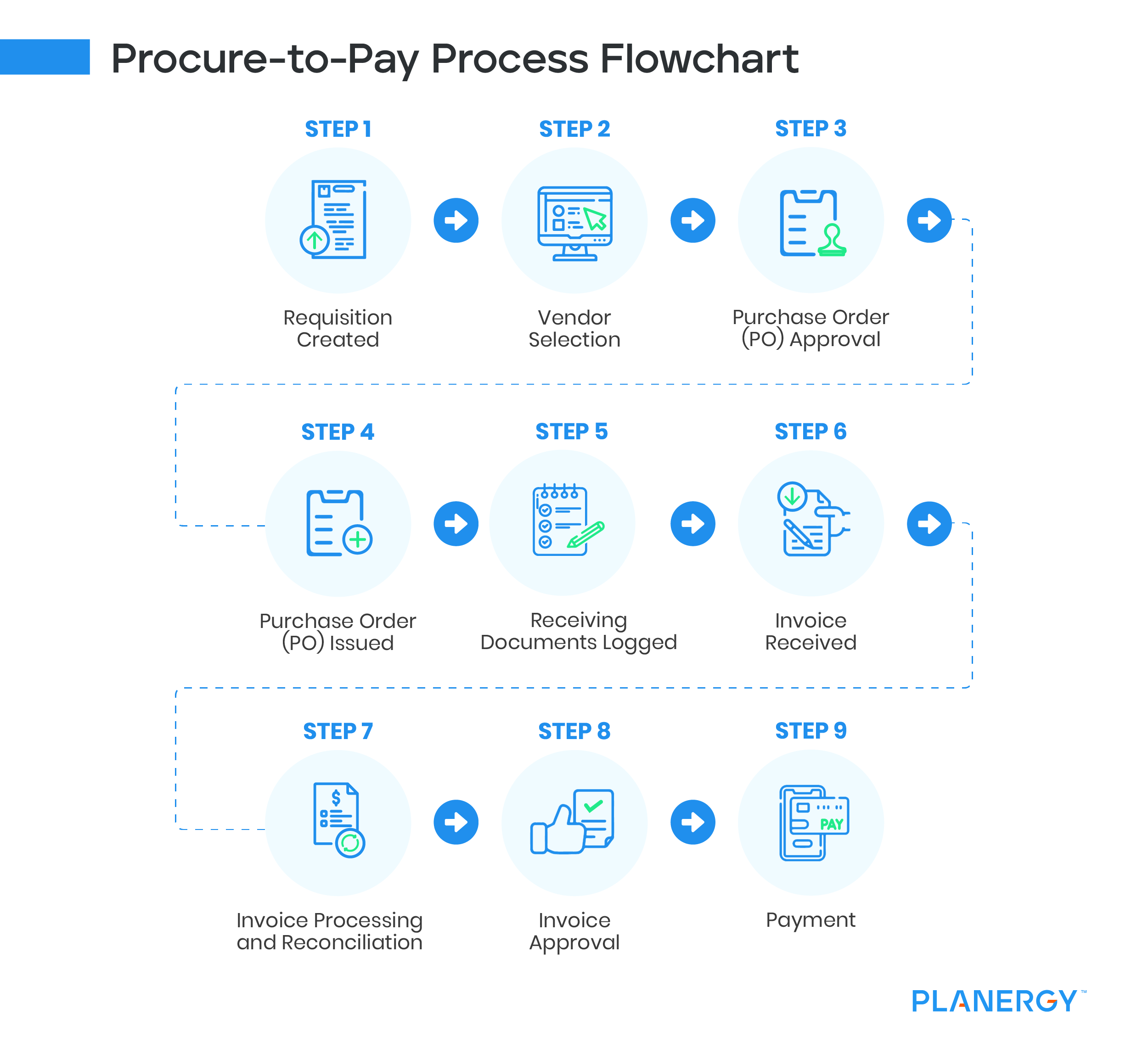

There are nine steps of the procure-to-pay process, shown below. In this section, we’ll break down exactly what happens at each step, and provide some tips on how to streamline the process.

-

Purchase Requisition Created

Purchase requisitions are internal requests for approval to make a purchase. Requisitions can be sent via a paper form or through procurement software where they are automatically routed to the correct approvers.

While many requisitions for routine items are quickly approved, organizations should keep room in their budgets for unforeseen purchases as well.

-

Vendor Selection

For regular purchases, the vendor will most likely already be selected from a preferred vendor list. For new orders, a vendor selection process begins.

This can either be a quick process of sorting through a short list of approved vendors, or the procurement department can send out a request for proposal (RFP) outlining the requirements.

When an RFP is placed, suppliers return a bid on the job, detailing turnaround time, price, and material specifications. Procurement teams weigh the following factors and even negotiate them with vendors:

- Quality

- Cost and delivery schedules

- Year-over-year price reduction

- Quantity discounts

- Future improvement in quality

- Freight and insurance costs

Compliance with relevant regulations and environmental, social, and governmental ( ESG) standards may also come into play.

-

Purchase Order (PO) Approval

Once the vendor is selected, managers and/or purchasing teams must approve the purchase order.

This will require the correct approvers to sign off on the document, either physically or digitally. In an automated system, POs are automatically routed to the correct approver for quick electronic approval. Once approval is complete, the purchase order process begins.

-

Purchase Order (PO) Issued

In this step, the purchasing team creates a purchase order with all the information the vendor needs to fulfill the order. Once the vendor receives the PO and formally accepts it, it becomes a legally binding contract that states that the vendor will provide these goods or services and the buyer will pay for them within a given time frame.

-

Receiving Documents Logged

The vendor delivers the goods or services and the relevant receiving document (usually a goods receipt or packing slip) is entered in the procurement system, with line items verified to ensure that everything ordered is delivered.

-

Invoice Received

The vendor submits an invoice, which is entered into the buyer’s accounts payable system. Automated systems often support electronic invoicing (eInvoicing) through the use of vendor portals.

-

Invoice Processing and Reconciliation

The invoice is reconciled against the PO and the receiving document (receipt or packing slip). In automated systems, the three-way matching process compares the purchase order and receiving document with the invoice to confirm that the goods were delivered and billed as ordered. Line items that do not match are flagged and reported for investigation.

-

Invoice Approval

Once it’s confirmed the invoice matches the receiving documents and the PO, it must be approved by the accounts payable team for payment. This may require double-checking with purchasers to ensure that the goods or services were received and of high quality, but three-way matching on its own is often enough for AP teams to approve routine invoices.

-

Payment

Invoices approved for payment are routed by the buyer’s finance team to accounts payable (AP). Vendor payments are made according to agreed-upon payment terms, and the accounting system is updated to reflect that the order was paid.