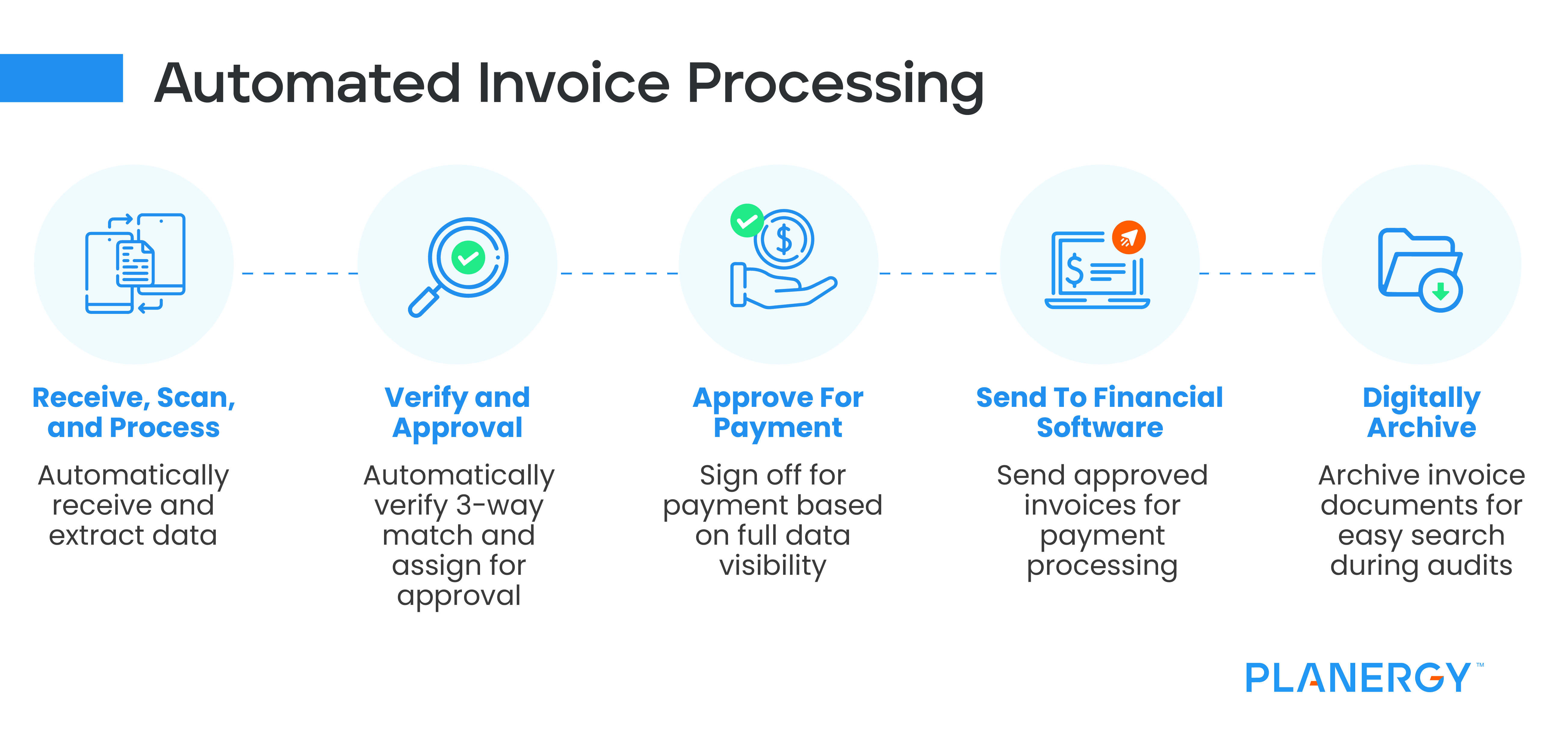

Automating your AP processes can make invoice approvals easier, starting with the verification process. These are just a few of the ways that using AP automation can streamline the AP approval process.

-

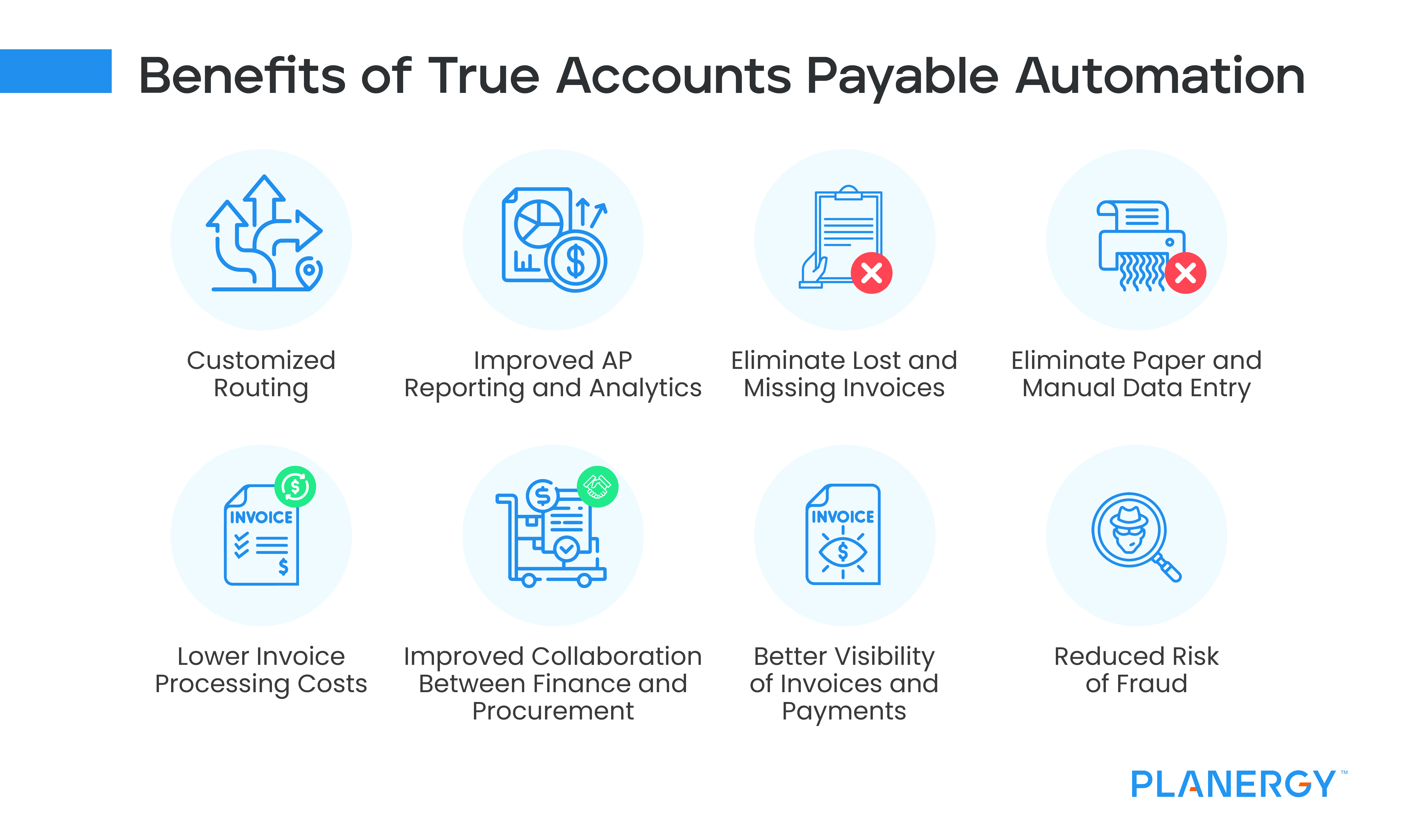

Customized Routing

It’s rare that all invoices are routed to the same approver. Automating AP allows you to customize the entire invoice routing process. For example, standard expenses such as rent and utilities may be routed to one approver, while product orders may be routed to several approvers.

When setting up custom routing, you can even set dollar limits, choosing multiple approvers for invoices over a certain dollar amount. Customized routing also allows you to route invoices based on additional criteria such as vendor, department, or project.

Once invoice approval workflows have been set, your invoices will automatically be routed to the appropriate party(s), with a reminder sent if the invoice isn’t approved by a specific date.

For invoices that require multiple approvers, you’ll need to first set the approval order, and once the first approver approves the invoice, it’s automatically sent to the next approver.

-

Improved AP Reporting and Analytics

Centralizing and automating procurement and accounts payable in a central hub will give you the data you need to report more fully and accurately in real time. Improving the speed and accuracy of financial close is a key benefit of automating AP.

-

Eliminate Lost and Missing Invoices

This is what can happen when invoices are routed manually to approvers.

A vendor invoice is received in your AP department five days after the product was delivered. Jane, your AP clerk spends part of her day tracking down the receiving document to match with the invoice.

Receiving document in hand, she performs the three-way match, codes the invoice for entering into the system, and places the invoice in an inter-office envelope to be delivered to the production department manager for approval.

The production manager receives the inter-office envelope later in the day. She takes out the items she has been waiting for, sees the invoice, and places it in a pile of papers on her desk to address later.

Three days later, the invoice is now buried under other non-urgent documents. Jane calls the production manager about approving the invoice. The production manager says she will look for it and get back to her.

The next day, the production manager informs Jane that she can’t find the invoice. Jane will now have to obtain another duplicate invoice from the vendor, eliminating the possibility of taking the early-payment discount.

Even worse, if Jane hadn’t contacted the production manager, it’s possible that the invoice would have remained buried on the manager’s desk, until the vendor called looking for payment, and possibly imposing a penalty or late fee.

Automating the AP approval process also eliminates manual invoices and reduces processing costs while getting rid of the typical bottlenecks described above.

-

Eliminate Paper and Manual Data Entry

AP Automation uses optical character recognition (OCR) to scan the information on the invoice and automate data entry.

While OCR accuracy is limited; when it is combined with AI and upstream data the accuracy and efficiency can be greatly increased. Reducing the number of manual processes followed will help decrease the number of errors.

-

Lower Invoice Processing Costs

By automating and reducing the manual human involvement in the invoice approval process you can greatly reduce the costs of processing and approving invoices. Exceptions rates will be reduced and bottlenecks removed ensuring a smoother AP process.

-

Improved Collaboration Between Finance and Procurement

Automating the three-way matching process will help your staff work together. Depending on invoice volume, AP clerks can spend an inordinate amount of time matching invoices against purchase orders and receiving documents.

That all goes away with accounts payable automation since the application will automatically read and extract invoice data from all relevant documents, examining each document for errors or inconsistencies. If any errors are detected, the document in question is flagged for manual review.

-

Better Visibility of Invoices and Payments

Centralizing data means members of staff that need to be given visibility on invoices and payments can be given access to do check. Solutions, like Planergy, give you granular control on what users have access to.

-

Reduced Risk of Fraud

According to the Association of Certified Fraud Examiners (ACFE)’s 2020 Report to the Nations, an average of 5% of revenue lost to fraud. This makes fraud prevention in accounts payable important for any company. Setting and automating the correct internal controls for accounts payable will greatly reduce your risk of fraud.

So you can give a head of department access to view only invoices related to their department but nothing else. This can take pressure off the finance team who would regularly be fielding queries about invoices and payments.