There are many benefits to e-invoicing for business partners. For buyers using an automated AP system, receiving an invoice electronically means that it will be scanned automatically into their AP system, eliminating the need to process invoices manually.

This is a huge benefit for businesses looking to cut down on the amount of paper they process manually while also freeing up internal resources to concentrate on more critical activities.

As more businesses turn to AP automation, there is an increased demand for automated AP applications like Planergy that streamline the entire procurement and AP process by automating once tedious tasks like data entry, three-way matching, and approval routing.

Using these systems helps automate the entire AP process by allowing users to quickly scan electronic invoices directly into the application, with Optical Character Recognition (OCR) used to eliminate the need to enter data manually.

But streamlining the AP process is just one of the benefits of e-invoicing. Whether you opt for true e-invoicing or use digital invoicing, these benefits are too great to ignore.

-

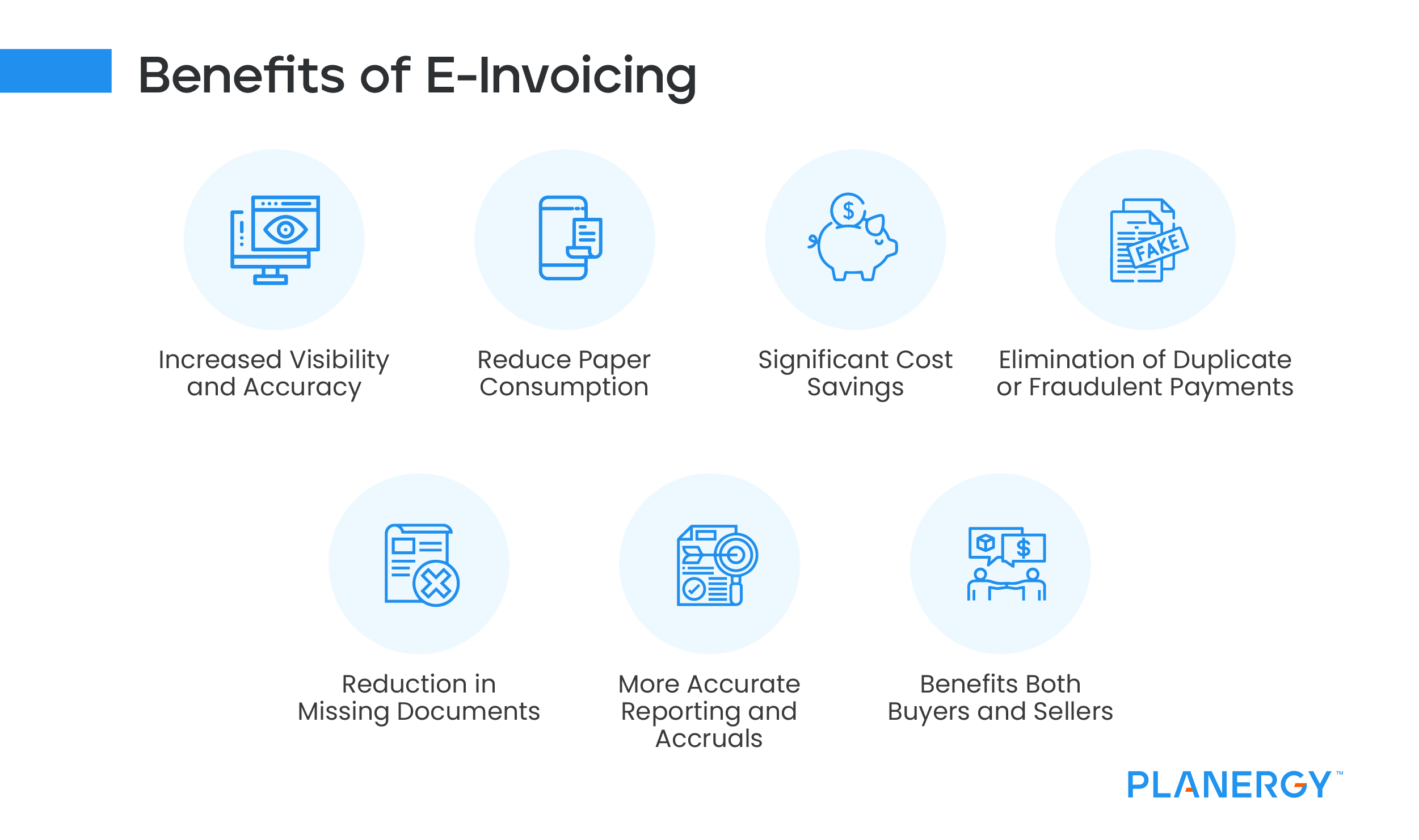

Increased Visibility and Accuracy

Using automated systems, including e-invoicing, gives managers and other stakeholders a better view of company finances and cash flow since invoice activity, purchase orders, and contracts are all visible.

Electronic invoicing also provides an in-depth view of the company in real-time, so you’ll always know how much you’ve spent, where you spent it, and where you need to cut down.

You’ll also be able to review the entire AP process from start to finish, easily viewing paid invoices, and those yet to be paid, with the ability to spot any potential payment delays before they become costly.

-

Reduce Paper Consumption

Besides saving money on paper and related supplies like ink, toner, and postage, making the switch to electronic invoicing and paperless AP also significantly reduces your carbon footprint.

And remember, all that paper has to go somewhere, so making the switch to an automated system will also save you on any associated costs such as storing documents at an outside facility.

-

Significant Cost Savings

When factoring in lost discounts, late payment penalties, a significant amount of data entry, and the cost of paper, postage, and envelopes, making the switch to e-invoicing can significantly reduce labor costs, freeing your employees to use their talents more productively.

These savings combined significantly reduce your accounts payable processing costs.

-

Elimination of Duplicate or Fraudulent Payments

Manual AP systems lend themselves to a significant amount of human error, including duplicate payments. Unfortunately, a manual AP system is also ripe for fraudulent activity.

Using an e-invoicing system eliminates duplicate payments while significantly reducing the risk of accounts payable processing costs.

-

Reduction in Missing Documents

Every time an invoice is sent in the mail, sellers are making the assumption that it will arrive at its destination timely. But the problem is, you’re relying on a system that you have no control over.

Mail gets lost or delivered to the wrong address. But even when the invoice is delivered properly, there’s no guarantee it will end up on the right desk. Paper invoices often get delivered to the wrong person initially or get routed to an approver, where they can sit for days.

With an e-invoice, you’ll always have access to a copy of the invoice, and after it’s been processed, it can be retained in electronic storage, making it easily accessible at any time.

-

More Accurate Reporting and Accruals

The stack of paper invoices sitting on your desk will not show up in your reporting totals until you enter them. Using an e-invoicing system, the minute an invoice is received or scanned into the system (for digital invoices), that total will be included in your payables.

Remember, that same stack of invoices can also impact your accruals and the accuracy of your reporting.

-

Benefits Both Buyers and Sellers

E-invoicing provides benefits for both buyers and sellers. For buyers using AP automation, receiving an invoice digitally can eliminate manual processing entirely, allowing them to scan the invoice directly into an AP automation system such as Planergy, which also works to streamline the entire three-way matching process, including easy matching of purchase orders and shipping receipts.

Using AP automation also provides automatic routing of the invoice for approval and quick turnaround on payment.

For sellers, using digital invoicing eliminates the need to manually create, print, copy, and mail an invoice to a buyer.

It also eliminates invoices lost in the mail, delivered to the wrong address, or simply getting lost once delivered.

And in many cases, when billed electronically, with an option to pay online, many buyers pay much earlier than those paying by check.

As noted, all of these advantages are dependent on whether buyers have automated their AP system. If you’re still processing AP invoices manually, receiving an invoice electronically will make no difference to your workflow.