Unfortunately, during this same time period, the number of businesses fully automated dropped from 20% in 2021 to only 12% in 2022, further indicating that businesses have a way to go before achieving to reach complete automation.

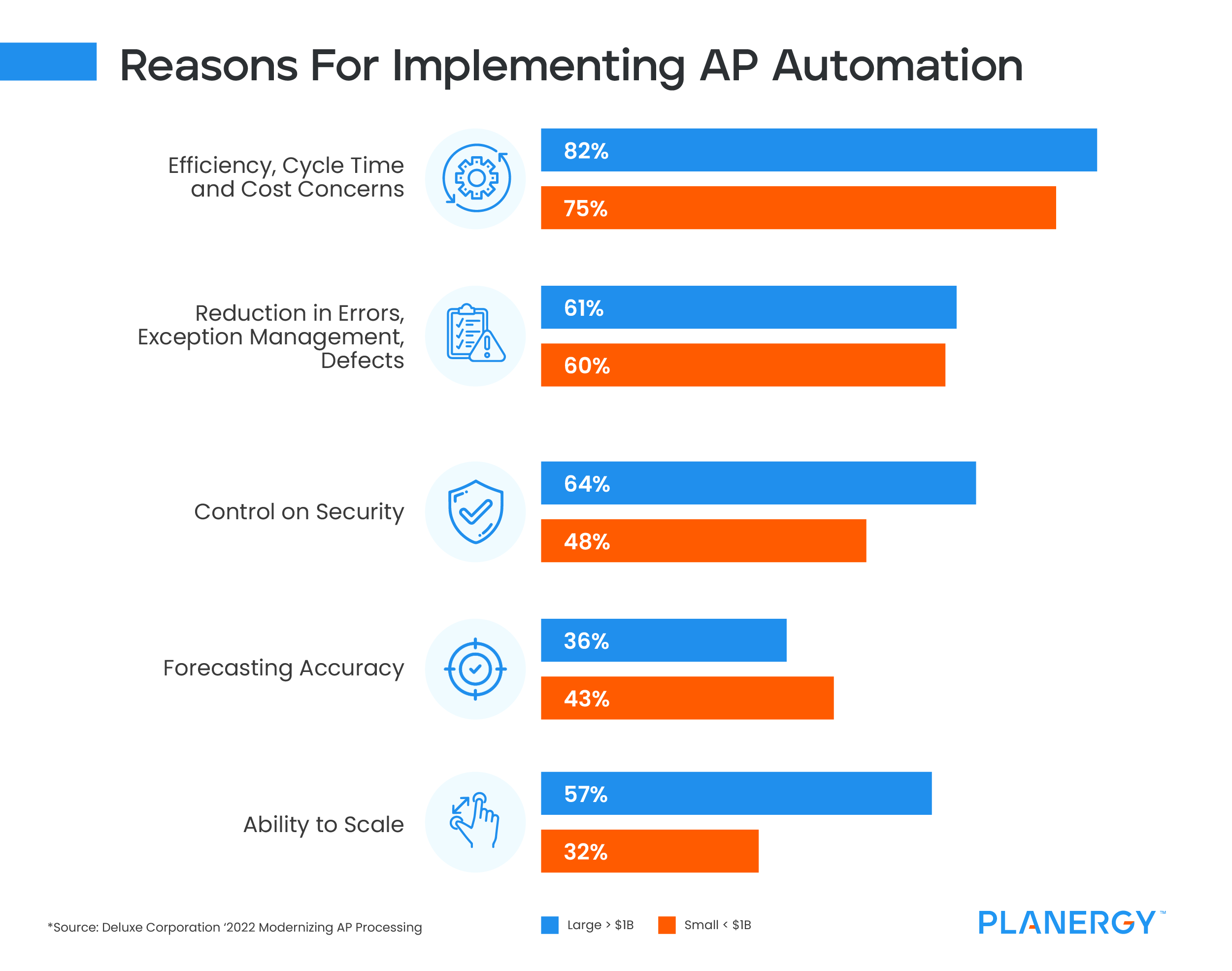

When asked the reasons they made the switch to an automated system, respondents had this to say:

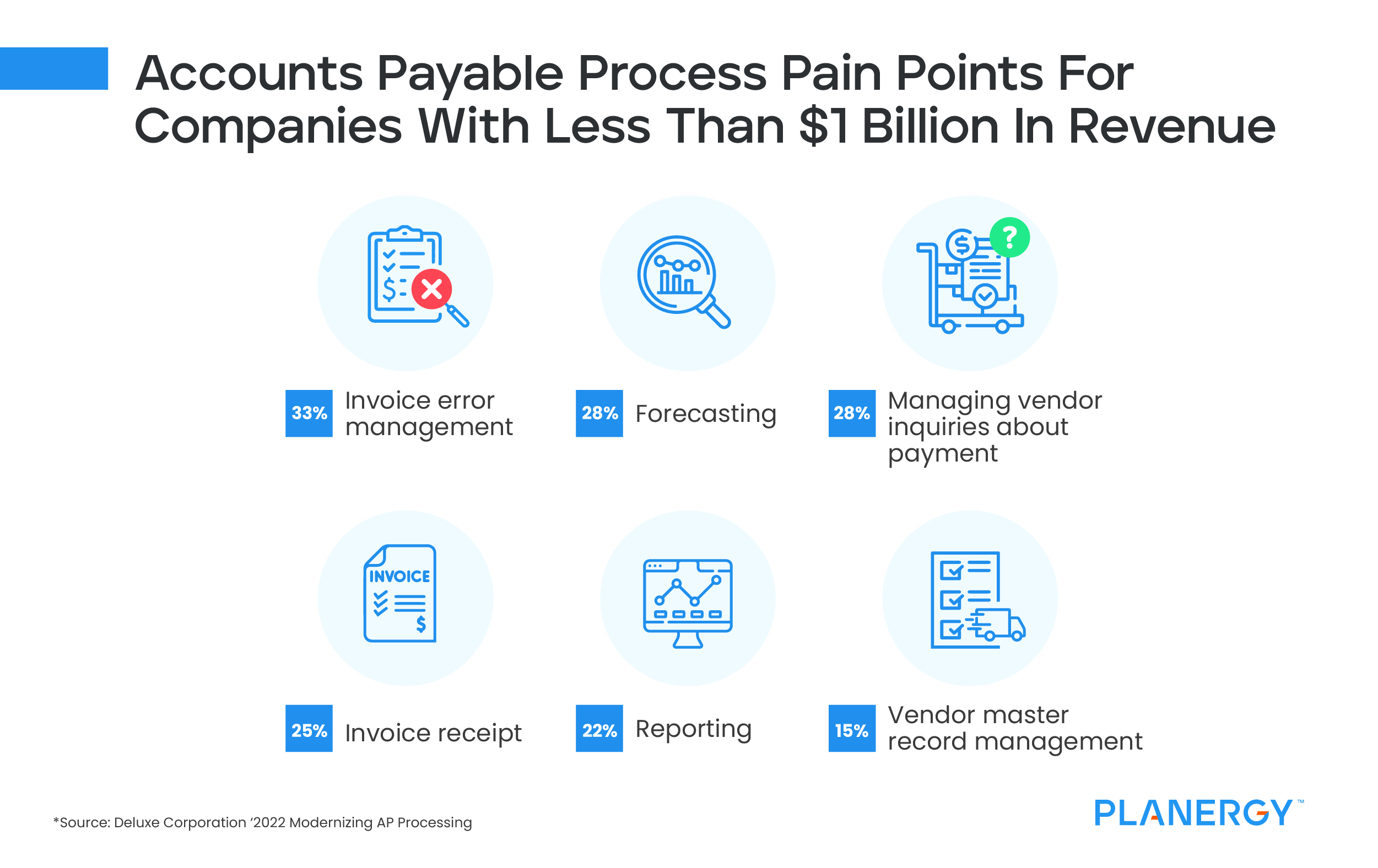

Small business survey respondents, those with less than $1 billion in revenue, also provided detail about their current AP process pain points:

Input errors, lost invoices, and delayed approvals all cost money. And while it’s clear that many larger businesses with revenues over $250 million are starting to embrace AP automation, smaller businesses are still struggling to make the change.

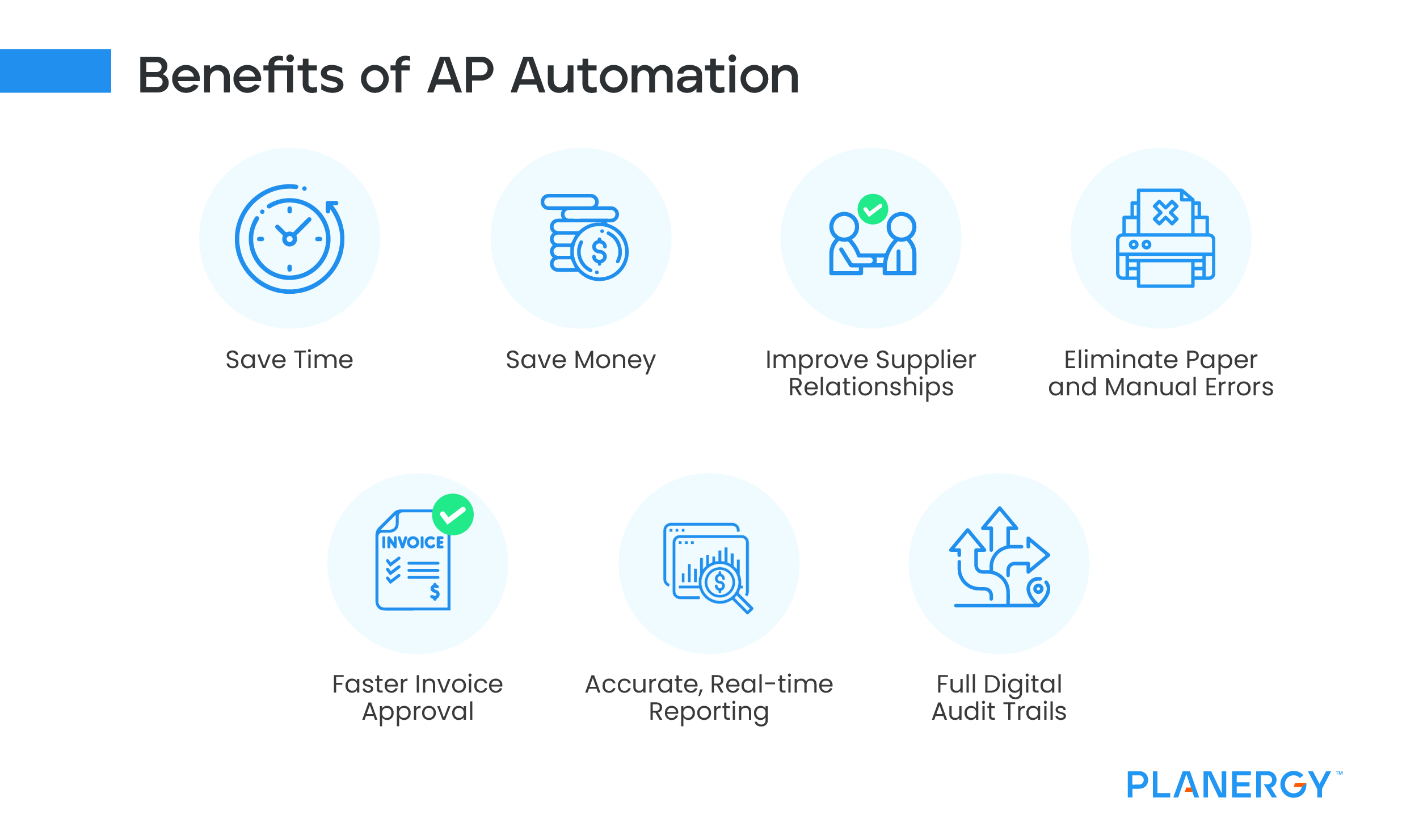

But when they do, there are a host of benefits awaiting them.

-

Save Time

One of the primary advantages of making the switch to AP automation is the amount of time you’ll save. Instead of manual data entry, invoices are scanned using optical character recognition or OCR technology, which reads and extracts invoice data. But that’s only the first step.

Once scanned, invoice approval is simple, with invoices routed to the appropriate approver(s) electronically, then returned to the AP team for payment.

-

Save Money

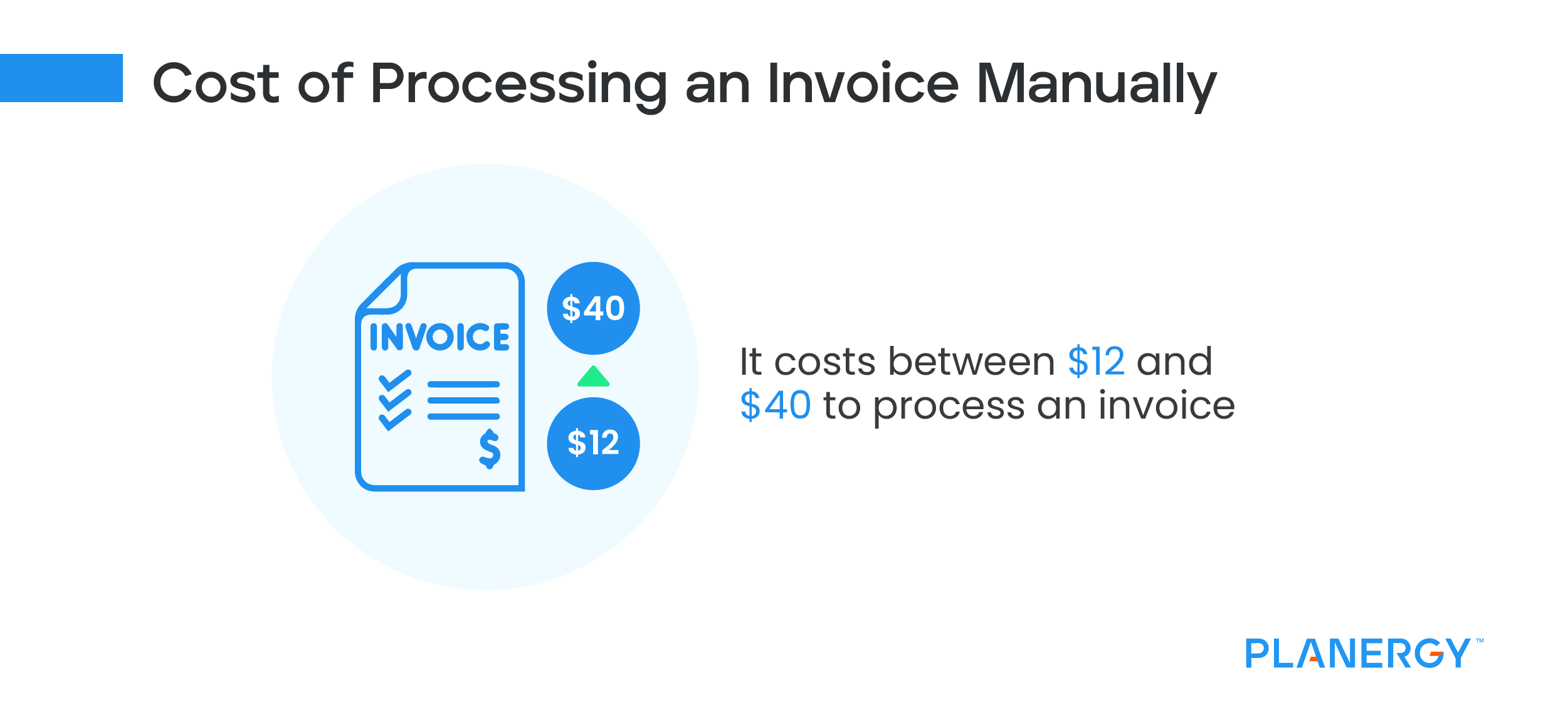

When you save time, you also save on labor costs. Labor costs are a key component of accounts payable process costs. Instead of paying staff to spend hours manually entering invoices and matching them with other documents, they can spend their time more productively.

With built-in document management and digital archiving, you’ll also save money on outside physical storage space along with check stock, postage, and envelopes.

-

Improved Supplier and Vendor Relationships

It’s difficult to maintain a good business relationship with your vendors and suppliers if payments are always late or invoices are lost. Implementing AP automation means timely approvals and on-time payments, resulting in more sustainable business relationships.

-

Eliminate Errors

Human interaction always means a higher probability of errors. Using AP automation reduces and can even eliminate human errors, making it easy to detect over-payments.

Automation also helps to identify and flag both duplicate invoices and duplicate payments as well as erroneous payments, eliminating the need to spend days trying to get money back from a vendor that was sent in error.

-

Faster Approvals

If you’re still manually routing invoices to other staff for approval, you’re likely aware of the delays that can happen. It’s not unusual for paper invoices to sit on a desk for days if not weeks.

They can get lost or misplaced, or routed to the wrong individual. Electronic approvals will automatically route the invoice to the correct individuals and send a reminder if it’s not approved in a timely fashion. Quicker approvals also allow you to take advantage of early payment discounts when offered while ensuring that your vendors and suppliers receive their payments on time.

-

Accurate, Real-time Reporting

Wondering where an invoice is in the payment cycle? With AP automation, you can easily find out. In addition, reporting becomes more accurate, with results displayed in real-time, so you don’t have to wonder how accurate a report is, or if all transactions are included in the report totals. In addition, with complete AP automation including a Procure-to-Pay solution, all transactions, from the initial purchase order to payment processing will be included in your report.

This real-time reporting allows you to make better strategic business decisions, monitor key performance indicators, and easily track cash flow at all times. With AP automation, you have the current status of your business at your fingertips.

-

Full Digital Audit Trails

When using a complete procure-to-pay solution, the entire process, from purchase order to vendor and supplier payment is tracked automatically and archived digitally. From the three-way matching of invoices, purchase orders, and shipping receipts, to more accurate accruals, as well as a committed spend report that lets you know exactly what you’re spending at any time.