How Do You Use the Variable Expense Ratio?

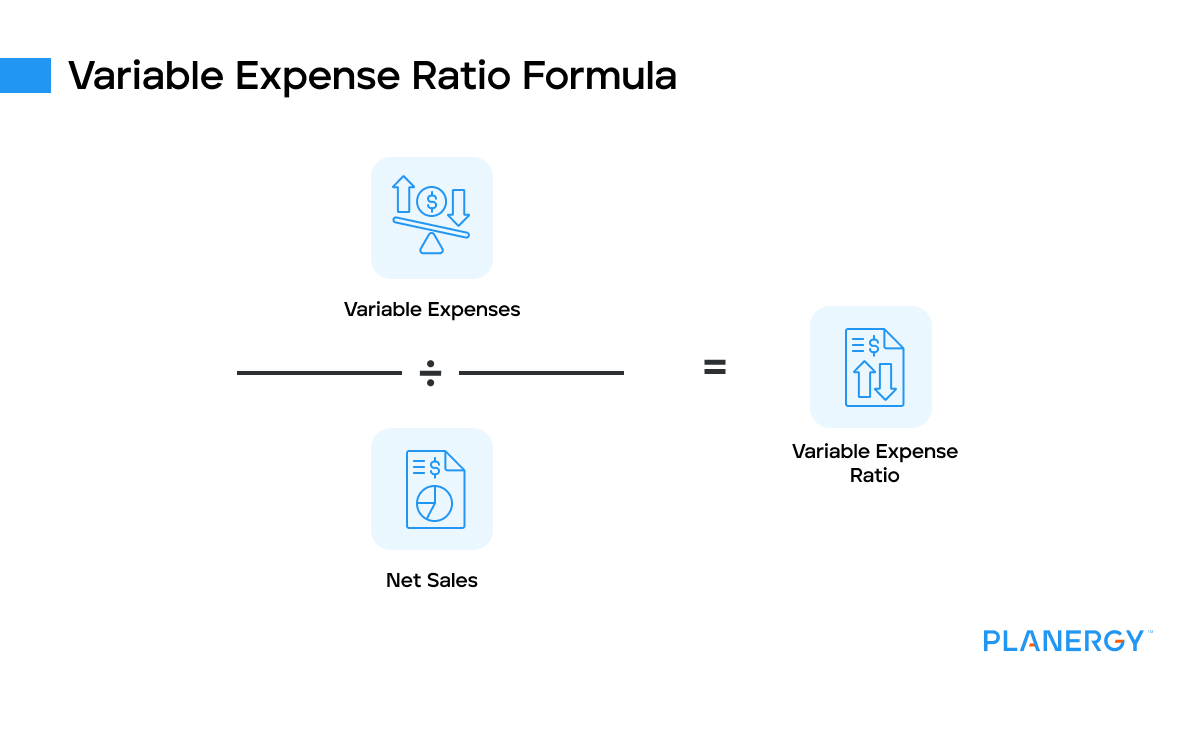

The variable expense ratio is a valuable tool for determining accurate pricing since it tells you exactly how much it cost to manufacture your products and how much your variable expenses will rise or fall if production rises or falls.

The variable expense ratio is best used when coupled with other financial ratios such as the contribution margin ratio and the breakeven point analysis.

The contribution margin is the amount of revenue a business has left over after variable expenses have been deducted.

For example, using the numbers from the above example, we’ll calculate James’s contribution margin:

($260,000 – $75,000) x $260,000 = 0.71 or 71%

This result indicates that after subtracting variable costs from revenue, James has 71% of his total revenue to cover fixed costs and other non-operating expenses.

Another ratio that is valuable to use with the variable expense ratio is the breakeven point ratio, which looks at when your products or services will become profitable after considering both fixed costs and variable costs.

The break-even analysis can be calculated on a cost-per-unit basis or by using the sales price per unit.

For example, if you wanted to calculate your break-even point you would need your total fixed costs along with the sales price per unit and the variable cost per unit.

James has monthly fixed expenses of $35,000. The selling price for a single product is $250, with a per-unit variable cost of $100 to manufacture it.

Using this information, you can calculate the break-even point for James:

$25,000 / ($250 – $100) = 166.66

Rounded up, this result means that James will need 167 unit sales to break even.

When calculating all three of these ratios together, you’ll have a much clearer picture of your business operations, including both fixed and variable costs.