With large, complex, and global supply chains, assessing vendor risk is not only more challenging but also more important thn ever.

Does your organization have a plan when a critical vendor fails to deliver?

What Is Vendor Risk?

Vendor risk is the possibility of vendor failure and supply chain disruption. For some businesses, if a vendor fails to deliver goods or services on time, it can mean losing money or even shutting down the business if they’re not prepared.

For example, if you’re in a furniture business, you rely heavily on lumber suppliers. If a disruption happens with one that you rely on and don’t have a backup for, your company could face serious issues.

Vendor risks depend on various factors such as geographic location, supply chain length, and business model.

In global supply chain risk, geography especially plays a major role. If a vendor’s facilities are based in a developing country, there is a higher risk of legislative changes, political unrest, or transportation challenges that could affect your business.

Why Do You Need To Manage Vendor Risks?

Supply chain managers need to manage a wide array of complex vendor risks, vendor relationships, and purchasing lifecycles.

In a frequently changing global environment, procurement teams have a lot to answer to, including profit margins, regulatory requirements, and customer expectations.

Failure to manage supplier risk can result in significant monetary losses from damage to the company’s reputation, regulatory penalties, production delays, product recalls, or catastrophic health and safety failures.

Therefore, effective vendor risk management is a key responsibility for procurement teams.

What Are the Types of Vendor Risk?

Every company has a unique supply chain with risks that are specific to their business.

However, there are common types of supply chain risk. Here are some of the more universal vendor risks that all companies face include the following.

Legal Troubles

Vendors who break the law, violate regulatory requirements, or engage in irresponsible practices can expose your company to lawsuits, loss of valuable certifications and government partnerships, and even prosecution.

Data Security Problems

Companies are increasingly integrating supplier software ecosystems with their own to streamline purchasing and other coordinated workflows.

Without data security protocols, integrating with vendor systems increases cyber risks. These risks include procurement cyberattacks where sensitive information is exposed in third-party data breaches.

Breached data exposes vulnerabilities that bad actors can exploit to steal funds, perform ransomware attacks, commit identity theft from your customer data, or steal and sell proprietary information.

Industry Compliance Issues

Depending on your industry, you may require your vendors to comply with certain regulations.

For example, healthcare companies need vendors to comply with the Health Insurance Portability and Accountability Act (HIPAA), which protects private health information and is strictly regulated with hefty fines.

Reputation Damage For Your Company

Vendors who fail to meet your standards cost you more than just fines for failing to meet compliance standards.

Unprofessional, unethical, or criminal behavior from suppliers can tie your company to their bad behavior—costing you your reputation with both the public and investors.

This is why you must factor in supply chain ESG as part of any vendor risk management program.

Your Competitive Advantage

In many ways, you are only as strong as the vendors you depend on.

If suppliers don’t meet their obligations for quality, performance, service, and delivery, it cascades down to your own company and gives your competitors an operational, financial, and reputational edge over your offerings.

There is real financial risk in supply chain if you are not working with the right suppliers.

What Is a Vendor Risk Checklist?

A vendor risk checklist is a list of tasks you should follow to protect your company from third-party vendor risk. It should serve as the cornerstone of your vendor risk management program.

To help evaluate an individual vendor, it can be helpful to run through a standard vendor risk checklist.

This vendor risk assessment helps you understand the risks of working with one vendor over another, and you can create a risk score based on the risk factors most important to you.

The checklist should help you understand operational risk, financial risk, compliance risk, and reputational risk.

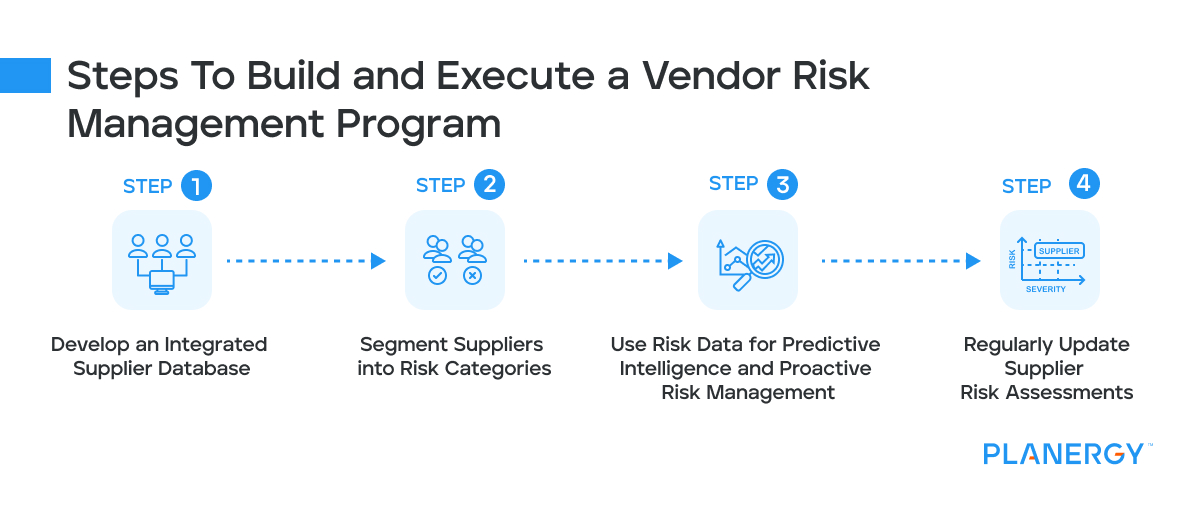

What Is a Vendor Risk Management Program? 4 Steps to Building and Executing Your Own

A vendor risk management program (VRM program) establishes effective controls and strategies to manage the many complicated aspects of vendor risk.

This program will help you find the data you need on supplier compliance, reliability, integrity, and production capability, then make informed decisions based on the risks found from that data.

Planning to manage and maintain strong relationships with key suppliers will play an important role in this.

Whether you’re a small business or a large enterprise dealing with tens of thousands of suppliers, these four steps can help you develop a robust vendor risk management plan.

Develop an Integrated Supplier Database

The first step to building and maintaining a vendor assessment program is to bring all of your supplier information into one centralized database.

eProcurement software can help, as it’s designed to consolidate supplier data while providing visibility and real-time insights into supplier performance.

Getting all your data in one system enables supply chain transparency, proactive compliance measures, and ongoing performance reviews for informed risk management.

End to end supply chain transparency is difficult to achieve, but getting as close as possible to that should be the goal to ensure you can achieve an effective supply chain.

It will provide actionable reports based on valuable data that help you hold your suppliers accountable. To properly manage risk, your procurement program must track all relevant internal and external data.

It should also streamline workflows across departments and business units, offering managers a clear picture of risk factors in real time—along with useful and actionable reports based on current data.

Effective vendor risk management requires end-to-end supply chain transparency, careful monitoring, continuous analysis, and predictive mitigation strategies for potential risks. This can only come from best-in-class procurement software.

Segment Suppliers Into Risk Categories

Using due-diligence data from internal and external sources, procurement managers should rank suppliers from low to high risk, based on an internal risk score that’s determined by factors that matter most to your business.

This can factor in the likelihood of an occurrence and the severity of the risk by utilizing the Kraljic matrix.

Vendors likely to disrupt operations should be given the highest risk core, while those who consistently meet regulatory compliance and performance standards should be considered low risk.

Create several buckets, again varying based on your need, and place all suppliers within one of them.

Once these supplier segments are identified, develop backup suppliers to ensure a quick pivot in the event of a major supply chain disruption. Supply chain agility will be important when any issues arise. Considering localized supply chain options can be helpful in this regard.

You should always have a failsafe option for suppliers you depend on for critical business operations.

Going beyond the data you track yourself, external data offers a more nuanced and comprehensive view of supplier risk.

Data you can use to evaluate suppliers beyond what you have in your procurement system can come from:

- The U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) economic and trade sanctions list

- Company financial information

- Business continuity plans and test results

- Data security and breach notification plans

- Vendor management plans (for companies that hire subcontractors or outsource raw materials)

Turn Risk Data Into Predictive Intelligence

The key to effective risk management is quality predictions. This means having plans in place to deal with a potential risk before it happens.

While no program can foresee every risk, predictive procurement analysis enables proactive procedures to cope with likely risks and their impact on company operations.

To prepare for potentially damaging supplier disruptions, craft alternative sourcing strategies by researching new suppliers.

Predictive analytics requires well-designed procedures and a deep understanding of supplier risk data. Using procurement software can help you automatically track data and set up reports that deliver real-time insights that keep you up to speed.

Keep Supplier Assessments Up to Date

Supplier risk can always change. Supplier risk assessments must be continuously updated to ensure they current and accurate.

Some suppliers will prove stable over the long run while others will suffer greatly from catastrophic events, sometimes outside of their own control.

The most useful tool to mitigate this is communication. By working with suppliers, a company can help suppliers develop supply chain contingency plans while mitigating its own risks at the same time.

Because the supply chain can fail for many reasons, companies can work with suppliers to work with the following types of scenarios:

Natural Disasters

A natural disaster can wipe out manufacturing facilities or shipping infrastructure.

Shipping failures can happen due damaged logistical routes. Damaged roads, rail lines, and ports can impact deliverability.

Businesses should assess transportation options as carefully as they scrutinize suppliers.

A contingency plan would include having suppliers in several global regions and ensuring there are alternate shipping routes in cases of problems with the preferred route, so you’re never dependent on one geographical region.

Geopolitical Events

A region can become unsafe to source from due to civil wars, government takeovers, protests, or other political tension. This may disrupt production or supply chain access.

Cultural research should be included in supplier assessment and monitored in countries where disruption is likely to happen as a result of these types of tensions.

Reduction in Quality of Goods or Services

Changes within your supplier’s organization can impact on their goods and services.

Management is cut or changed due to the need to cut costs. This sometimes also means cutting quality or skirting regulations. Continual assessments keep you on top of these changes and always informed of your supplier’s performance.

Regulatory Changes

Regulatory changes in sourcing or labor laws influence the availability and pricing of raw materials and finished goods.

Usually, you can be aware of these changes ahead of time if you stay on top of local politics and news in the countries you and your suppliers depend on.

It’s impossible to accurately predict all supplier failure, but you can plan ahead for disruptions from critical suppliers by putting alternative sourcing strategies in place.

You should have alternate suppliers already vetted and approved. You should also map out alternative shipping routes to ensure you have an option when roads, rails, or ports are destroyed by natural disasters.

What Are Vendor Risk Management Best Practices?

Vendor risk management best practices guard your company against the risks that your third-party supplier relationships create (and fourth-party relationships with their suppliers).

The following best practices will ensure that you are properly executing due diligence, risk assessments, and third-party risk management.

Invest in a Comprehensive Procure-to-Pay (P2P) Solution

Managing vendors is complex. It includes negotiations, onboarding, relationship management, and performance tracking—all of which should lead to mutually beneficial partnerships.

But you can’t manage what you can’t see. Centralized P2P solutions, like Planergy, give you full transparency into your spend data and allow you to apply business process automation and gain automated spend analytics to your vendor management workflows.

This gives you real-time visibility into potential vendor risks and an effective toolkit for tracking performance and compliance.

A P2P solution may include the following vendor management capabilities:

Customizable dashboards that can show all your suppliers along with useful data that helps you identify supplier performance, high-risk suppliers, opportunities to consolidate suppliers, and more.

This insight can help you understand your supply chain integrity and identify which vendors should become trusted partners to involve in shared initiatives.

Business process automation for procurement, supplier approval, and AP Automation software for better managing the full procure-to-pay process.

Data analytics and business intelligence tools that enable you to evaluate potential suppliers and their risks more effectively.

A simplified and secure vendor onboarding process that includes integrations of service level agreements (SLAs) as part of contract management.

The ability to securely integrate vendor systems. This makes it easier to monitor contractual and regulatory compliance, ethical business practices, and overall performance.

Tools for continuous monitoring of vendor management KPIs and procure-to-pay KPIs in real-time, allowing you to quickly respond to high-risk behaviors and threats.

Guided buying systems and PunchOut catalogs that help you automatically enforce contract compliance.

Centralized, secure vendor data storage and data protection to reduce cybersecurity risks.

A vendor self-assessment tool that helps create a shared commitment to compliance, quality, and performance.

Create a Dedicated Vendor Risk Management Team

As a part of ongoing monitoring, it’s helpful to have a dedicated vendor risk management team.

These may be people on your information security team or within your procurement team, and it may not be their main job. However, having a dedicated team of experts overseeing vendor risk ensures issues will be identified and dealt with more quickly.

This team can also draft, communicate, and enforce policies that will help ensure your company is complying with laws, like GDPR, and following the wider company governance, risk, and compliance (GRC) goals.

This team’s goal should be to ensure everyone views themselves as a stakeholder in managing vendor risk and complies with internal security controls.

Formalize Your Vendor Risk Assessment Process

Obviously, you shouldn’t be adding just any new vendor you find, but instead onboarding them through approved protocols—beginning with a formal vendor risk assessment.

Whether you use a simple questionnaire or a multi-stage digital onboarding assessment, a P2P solution with vendor management tools is extremely helpful. It will allow you to track all relevant vendor information and documents within one centralized system.

This streamlines the process and starts the supplier integration process automatically.

Suppliers whose risk profiles are unacceptable, don’t have a proven track record, or don’t meet your standards for compliance and performance are identified and never make it to an approved vendor or preferred vendor list. Better-qualified candidates can be reviewed quickly.

Identify and Monitor Vendor Performance Metrics

Whatever the requirements you’ve set for your goods and service providers, establishing and tracking KPIs throughout the vendor lifecycle will make you aware of how well they’re performing.

Common KPIs you might track include cybersecurity strength, HIPAA compliance, on-time delivery rate, or quality measurements. If you have a focus on ESG and sustainable procurement then this might also include metrics for sustainable materials usage.

This is another area where digital tools provide an advantage. Real-time monitoring, analysis, and reporting allow your team to adjust your supply chain to guard against reputational, operational, or financial damage from third-party vendors.

Manage Risk From Fourth-Party Vendors

While you most likely don’t have any direct legal agreements with your suppliers’ vendors, they can still introduce risk into your supply chain.

Consider establishing standards as part of your own supplier requirements. Give vendors clear direction on how you’d like them to assess, monitor, and manage their own suppliers—and that there will be consequences if they don’t meet your standards.

You’ll reduce your total risk exposure, reduce the need for remediation, and further refine your supplier assessment and onboarding processes by eliminating suppliers who don’t meet your standards.

Make Vendor Risk Management Part of Your Business Continuity Planning

Your suppliers can expose you to dangerous levels of risk from data security issues, materials issues, and unethical or illegal behavior.

In fact, they can threaten the very existence of your business. Vendor risk management is closely linked to avoiding business disaster response and recovery—and should be treated like it.

To protect business continuity, integrate your vendor risk management program into your larger business continuity planning.

Ensure that you have contingencies in place to immediately remove and replace any supplier that fails to meet your standards or creates unacceptable levels of risk.

How Can a Company Reduce Vendor Risk?

Following the steps outlined in building your own vendor risk management (VRM) program and following the best practices for vendor risk management will help your company reduce vendor risk.

Vendor selection and the associated risk management process is no small task, which is why tools like procurement software are necessary to successfully execute your program.

It’s not just selecting the right tools, but using them effectively. Understanding the steps outlined in this article and pairing that with Planergy’s procure-to-pay platform will give you the set of tools you need to reduce vendor risk and help your business ensure long-term continuity and success.