No company wants to throw their money away, especially in uncertain times when every dollar makes a difference.

From small businesses to large enterprises, competitive strength in the global economy comes from optimizing processes to boost savings and reduce waste, and proactive—rather than reactive—strategies.

One way to build competitive strength is to implement the right comprehensive spend management software solution, sometimes used interchangeably with the term procure-to-pay software.

It can be incredibly effective in boosting productivity, eliminating waste and needless expense, and generating value through digital transformation.

But in order to reap these benefits, you must first understand what spend management software is and the many specific ways in which it makes these improvements possible.

What Is Spend Management Software?

Spend management software helps keep company spending under control and ensures businesses get the maximum bang for each buck. It gives companies visibility and control over their spending, ensuring they’re able to cover debts and find profitability.

The main goals of spend management software are:

- Manage obtaining of goods and services

- Maximize return on investment (ROI)

- Minimize waste and expense

- Gain spend transparency

- Enforce compliance

- Reduce risk, including risk of fraud

- Automate business processes

- Generate cost savings and value through insights

Planergy’s spend management software supports these goals with technologies like artificial intelligence, deep data analytics, and business process automation.

Incorporating advanced accounts payable automation software directly into the procure-to-pay workflow does a much better job of optimizing and automating accounts payable than a standalone solution.

It’s designed to eliminate errors and waste while simultaneously maximizing productivity and value creation throughout the procure-to-pay (P2P) process.

Spend management software is a key component in any company’s digital transformation strategy. It’s also an important part of business process management. It help in areas such as continuous improvement, data-driven strategic planning, and centralized, real-time collaboration and communication.

Artificial intelligence and machine learning are used to automate procurement processes from generating requisitions and purchase orders to verifying invoices via automatic three-way matching.

What Is The Difference Between Expense Management And Spend Management?

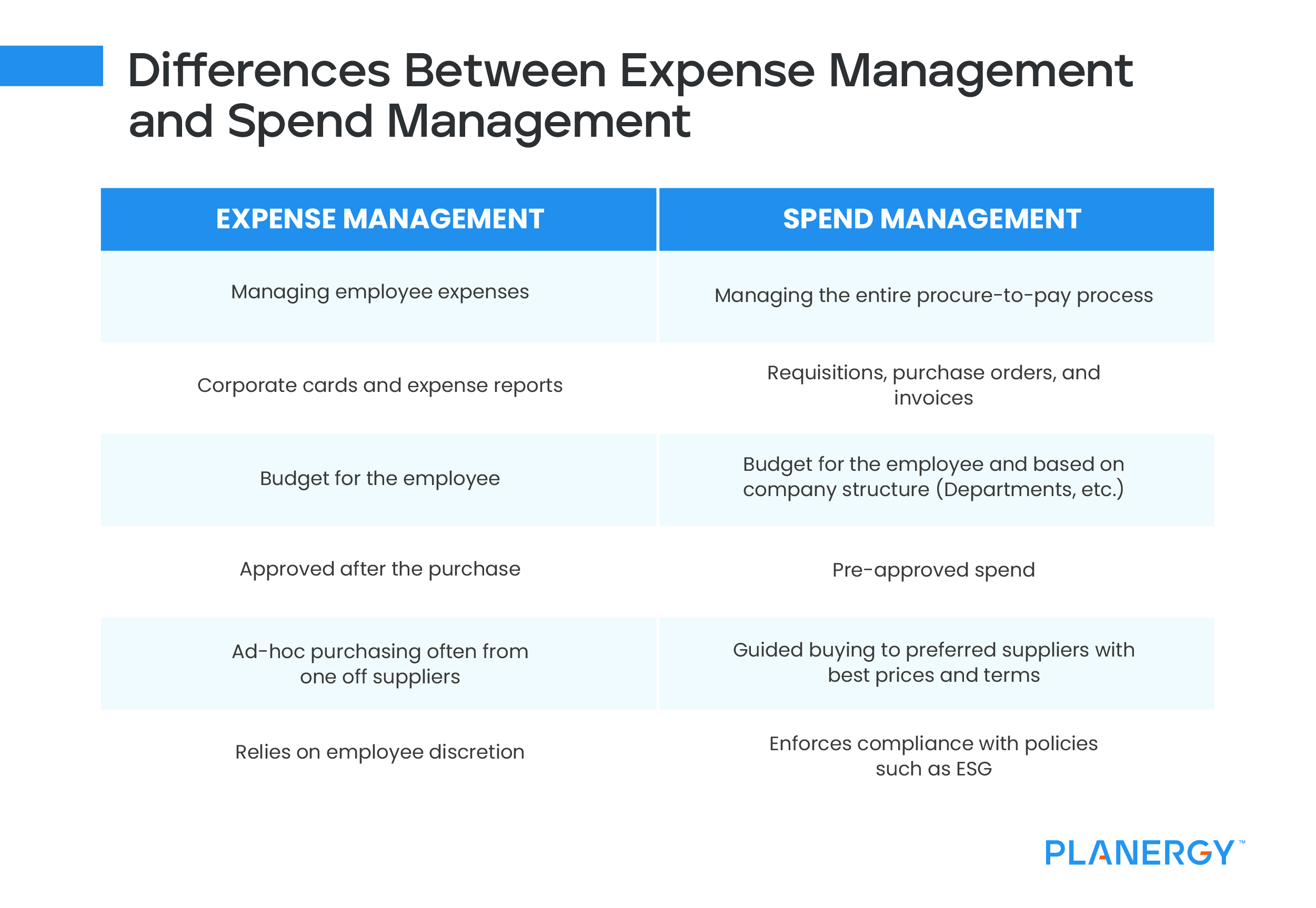

While they may sound similar, expense management and spend management are not the same thing. Expense management involves managing money that employees spend on their daily jobs, such as travel and meals for tradeshows.

This is usually managed on corporate cards or by reimbursing employees when they pay out of pocket for company purchases.

Often expense management stretches to incorporate more than this with office supplies for a new employee, or ad spend on a new marketing campaign all running through an expense card.

Spend management is about ordering the goods and services that a business needs to operate successfully, such as raw materials or consulting services.

This should include office supplies and marketing spend to ensure preferred vendors are used and budgets are respected. Spend management is the entire procure-to-pay process, including purchasing, procurement, accounts payable, and final payment approvals.

Expense management involves setting budgets for employee spend, getting corporate credit cards to pay for employee expenses, and processing expense reports. Spend management involves sourcing suppliers, creating requisitions and purchase orders, and ensuring proper payment through accounts payable.

| Expense Management | Spend Management |

|---|---|

| Managing employee expenses | Managing the entire procure-to-pay process |

| Corporate cards and expense reports | Requisitions, purchase orders, and invoices |

| Budget for the employee | Budget for the employee and based on company structure (Departments, etc.) |

| Approved after the purchase | Pre-approved spend |

| Ad-hoc purchasing often from one off suppliers | Guided buying to preferred suppliers with best prices and terms |

| Relies on employee discretion | Enforces compliance with policies such as ESG |

5 Ways Spend Management Software Benefits Your Business

Spend management software provides benefits by helping companies consolidate their spend management and integrate its improvements with their overall systems. It gives companies a centralized and comprehensive hub for extracting value from the procurement process.

Let’s take a closer look at five of the ways eProcurement software solutions can help you save time, improve user experience, and ensure company spending is focused on value as well as savings.

-

Improved Efficiency

Procurement software uses process automation, iterative improvement, and centralized data management and analysis to increase the speed and accuracy of routine processes throughout the P2P cycle, including:

Spend Control

- Guided buying directs purchases to the best vendors and pricing for the goods and services you purchase.

- Unnecessary purchases, maverick spend, and invoice fraud are substantially reduced or eliminated.

- Increased accountability through accurate and complete expense reports.

- Improved downstream processes like cash flow management, budgeting, and financial reporting/auditing.

- Automate high-volume, time-consuming, and repetitive tasks.

Real-time Spend Analysis

- On-demand advanced spend analytics of all spend data.

- Reveal hidden patterns and opportunities for additional cost savings.

- Improved user experience with web-based dashboards accessible from mobile and desktop devices, across platforms.

Strategic Sourcing

- Identify strategic sourcing opportunities from accurate spend analytics data.

- Enforce compliance for purchasing from preferred suppliers.

- Full spend visibility and access to historical data allow for strategic changes to capture greater savings, set better terms, and minimize risk exposure.

Supplier Relationship Management

- Analysis of vendor performance data, compliance data, and spend data strengthens your position in negotiations.

- Faster vendor onboarding

- Clearer and faster communication

- Smoother contract management processes

- Automated vendor portals create a better vendor experience

Accounts Payable Automation

- Automate invoice processing and greatly reduce manual tasks freeing up your team to focus on value add tasks

- Reduce paper and digitally archive all documents automatically

- Strengthen accounts payable internal controls

- Automate three-way matching to streamline invoice approval

- Greatly reduce the number of exceptions and supplier queries to ensure faster payment processing

-

Improved Risk Management

Avoiding needless expense is as important as keeping track of what you’re actually spending. Implementing a spend management platform helps reduce risk in a number of ways:

- Stay up to date on internal and external risks through the comprehensive analysis of spend data, and supplier performance and compliance metrics.

- Key performance indicators (KPIs) can be established to measure internal process and spend efficiency against benchmarks.

- More complete and accurate data simplifies financial forecasting, financial close, reporting, as well as internal and external audits.

- Role-specific access for stakeholders improves communication and collaboration, simplifies supplier relationship management, encourages strategic partnerships, and reduces the risk of costly misunderstandings and reputational damage.

-

Lower Costs for Goods and Services

Spend management software makes it easier to negotiate for lower costs. It creates insights by providing total spend visibility and KPIs for vendor performance and compliance. Having this knowledge creates contract management negotiating power and can empower companies to get better pricing.

The more well-developed your supplier relationships are, and the clearer your vision of your upcoming needs and expenses, the more effectively you can secure lower prices at the negotiation table.

Additionally, using spend management software makes it easier to pay approved invoices faster—unlocking opportunities to capture early payment discounts or negotiate better terms for faster payments.

-

A Fully Integrated Software Environment

The best spend management platforms integrate with your existing enterprise resource planning (ERP) solutions and/or accounting software, and other systems to create a central hub where everyone has level-appropriate access to all the information they need for:

- Cost-effective purchasing of goods and services.

- Collaborative initiatives supporting overall organizational goals.

- Implementation of spend management best practices across the entire organization.

-

Stronger Business Intelligence

Business intelligence produces smarter spending and sourcing, and is a natural byproduct of the analytics and insights supported by spend management software. It helps procurement teams focus on valuable strategic planning and relationship building instead of data entry or chasing exceptions.

Business intellgence insights enable teams to review internal practices, vendor performance, and overall spend patterns to make decisions and implement policies that improve efficiency.

This intellgence creates profits and supports a resilient supply chain—ensuring business continuity is protected from unexpected disruptions.

What Is The Best Spend Management Software?

The best spend management tool for your organization depends on your needs. Some organizations may be seeking expense management software for managing employee expenses, while others may need a full-on enterprise suite. Mid-size organizations may be in the market for a robust system but don’t have enterprise-level needs.

To determine what spend management software providers serve your needs, it’s helpful to understand the different categories and the features available within them.

Expense Management

As stated earlier, expense management software is not the same as spend management. Programs like Expensify, Divvy, and Ramp are mainly about managing employee expenses, receipts, reimbursements, and expense reports—not managing your entire procure-to-pay process.

Expensify

Expensify is a well-known receipt and expense tracking system that helps organizations manage employee expenses. It allows users to snap a photo of a receipt and upload it for categorization and approval.

Pros:

- Easy way to manage employee expenses and receipts

- Increases the speed and efficiency of creating expense reports

- Expedites employee expense approval workflows

Cons:

- Does not manage procurement or accounts payable functions

- Some users report poor customer support

- Many don’t like the reporting system

SAP Concur

While technically an enterprise-level spend management system, SAP Concur is more focused on employee and travel expenses than the entire procurement lifecycle. It provides analytics tools and integrates with many other systems to help companies manage their spend.

Pros:

- Rates higher on review sites than SAP Ariba

- Good for managing employee business expenses and travel

- Electronic submissions and automatic payments speed up expense management processes

Cons:

- Focuses more on employee expenses than the overall procurement function

- Many report poor customer service

- Requires extensive customization to get set up

Accounting and Bookkeeping

Accounting and bookkeeping systems are mainly used by accountants to manage a company’s books and records. They include things like profit and loss statements, preparing tax returns, and other internal functions.

Like expense management platforms, they do not manage the entire procure-to-pay process. Two popular platforms are QuickBooks and Xero.

QuickBooks

One of the most popular accounting systems with 4.5 million users, Quickbooks helps businesses organize their books, keep track of expenses, track their inventory, run payroll, and send invoices to customers.

Pros:

- Most widely used accounting software by industry professionals

- Large library of add-ons and reports

- Provides everything a business needs for accounting and bookkeeping

Cons:

- Does not manage procurement or accounts payable functions

- Can be difficult to learn how to use

- Users report lack of customer service

Xero

An accounting and bookkeeping app for small- to medium-sized businesses, Xero is a lighter, cloud-based software that many businesses enjoy using. Xero helps finance teams take care of bills and invoices, manage their cash flow, and see what bills are due for payment.

Pros:

- Popular with smaller businesses and bookkeeping professionals

- Easy to set up and use

- Cloud-based functionality makes it lighter and faster than desktop alternative

Cons:

- Does not manage procurement or accounts payable functions

- Lacks integrations with key systems for inventory management

- Tracking and reports are more limited

Enterprise Spend Management Solutions

Enterprise systems do offer full coverage of procure-to-pay workflows, but they are tailored for large enterprises and may seem overly complicated for small- to medium-sized companies. Examples include Coupa and SAP’s Ariba and Concur.

Coupa

Coupa is an enterprise-level and cloud-based spend management system designed for large enterprises. It helps customers manage and control their business spend, supply chain, and procure-to-pay process.

Pros:

- End-to-end processes for multiple departments including procurement, finance, and compliance

- Has modules for many different functionalities across the procure-to-pay lifecycle

- Known for good security systems

Cons:

- Integrating with outside systems can be a long and complex process

- May be overly complex for medium-sized businesses

- Considered to provide lower value for money than competitors

SAP Ariba

Ariba is a web-based application that helps larger enterprises make purchases, sell goods, and manage company spend. It can perform all of the main functions of the procurement cycle, but has lower rated reviews than many competitors on software review sites like G2.

Pros:

- Many prefer Ariba’s cloud-based platform to on-premise server alternatives

- Can be simple to use once it is set up

- Manages the full procurement cycle

Cons:

- Low overall reviews and value reviews on review sites like G2

- Users report frequent issues with incorrect invoices

- Not ideal for mid-size businesses

Mid-Size Business Spend Management Solutions

Planergy

When it comes to solutions made specifically for mid-size organizations that need to manage their entire procurement process from purchasing to accounts payable, Planergy is the premier choice. No other software fully serves mid-size businesses in this way, and Planergy aims to fill that gap with a top-tier solution.

Planergy streamlines and automates the entire procurement process from generating requisitions and purchase orders to automatic three-way matching. It also provides powerful tools for real-time visibility, contract lifecycle management, and supply chain optimization.

Pros:

- Consistently rated as among the best spend management solutions on review sites like G2

- Simple to use and can be implemented in a couple of weeks

- Customizable, multi-company app suitable for any industry sector

Cons:

- Cloud software, not suitable for companies that want an installed solution

- Has many integration options for leading accounting softwares and ERPs but some companies will prefer all company data in a single ERP

Spend Management Software Boosts Savings and Productivity

Procurement leaders around the world know it’s not just what you’re spending, but how you spend it that affects your company’s ability to generate value and compete effectively. Spend management is much more effective, intuitive, and manageable with a quality spend management software solution.

Software allows you to take control of company spend. It helps drive continuous improvement, process optimization, supplier relationship management, better cash-flow management, and strategic decision making. Ultimately, it generates a healthier bottom line and adds value to your business.