-

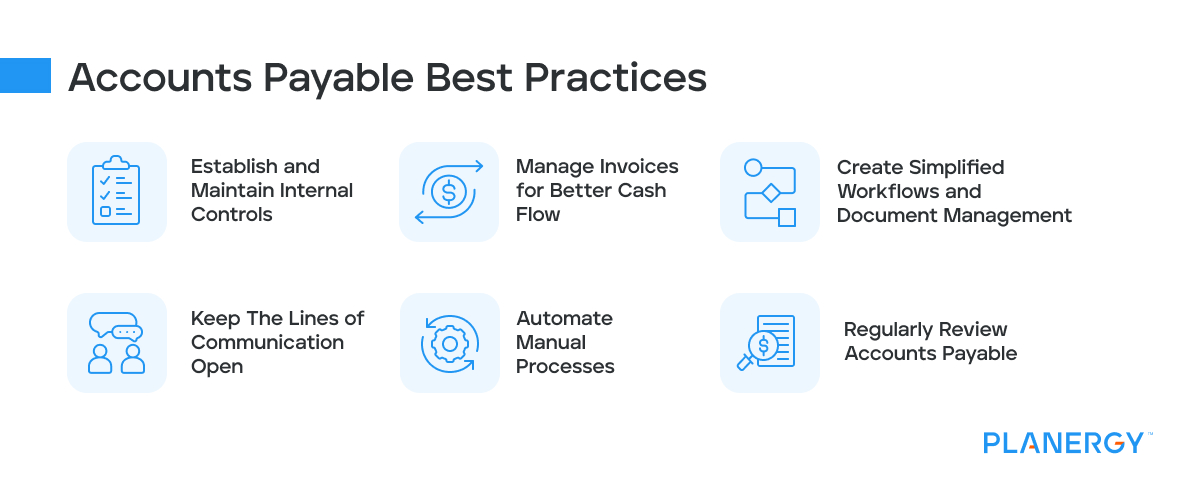

Establish and Maintain Internal Controls

Everything starts with having the proper internal controls in place.

These internal controls should include the following:

-

Separation of Duties

Separation of duties is essential for maintaining best practices. AP tasks should never be solely handled by a single employee.

Tasks should instead be separated so that there are checks and balances throughout the entire AP process, from initial vendor selection, to who is responsible for approving invoices and finalizing payments.

-

Proper System Access

Many issues can be resolved or eliminated by assigning the proper system access to AP staff.

While it’s imperative that staff be able to perform their job duties completely, they should be provided with the access to do that and nothing more.

-

Using Detective Internal Controls To Spot Issues

Proper inventory management, promptly reconciling bank statements, running financial statements, and reconciling general ledger accounts regularly are all designed to spot issues.

-

Taking Corrective Action

Locating issues promptly is important, but just as important is taking the proper corrective action once an issue has been identified.

This action can include anything from updating current policies and procedures to taking disciplinary action such as issuing a warning or terminating an employee, depending on the issue that is discovered.

-

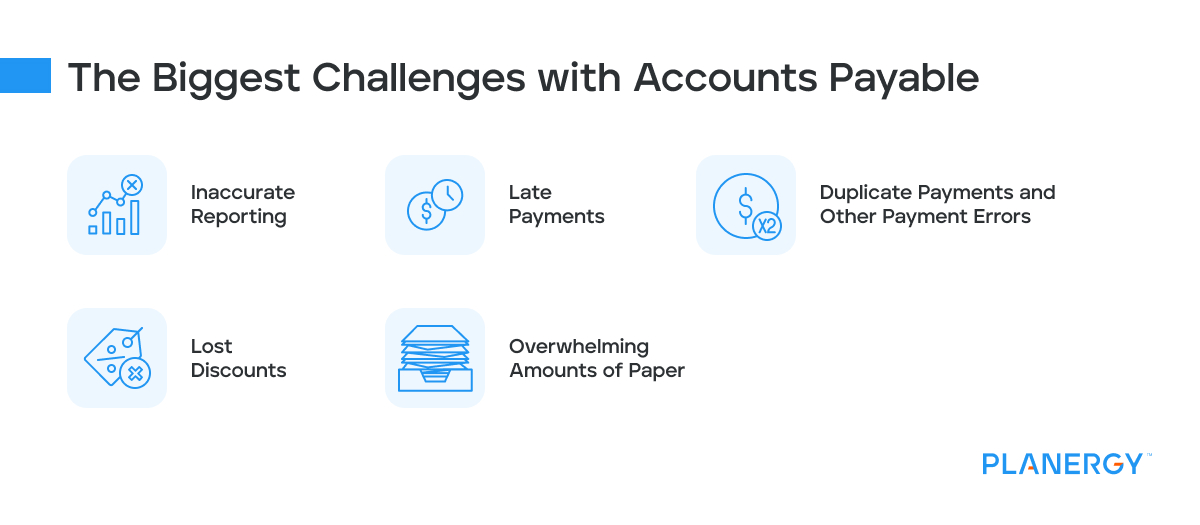

Create Simplified Workflows and Document Management

Creating simplified workflows and document management procedures can have a significant impact on your business.

This starts with streamlining the accounts payable process, which includes the initial invoice matching process (ideally three-way matching), routing invoices to the correct individuals for approval, and reviewing reports and other relevant documents to search for duplicate payments.

-

Manage Invoices for Better Cash Flow

Though your first instinct may be to pay an invoice immediately, that’s not always recommended.

Instead, you may want to pay invoices that offer a discount and take advantage of the payment terms you have with your vendors.

These terms commonly range from 30 to 60 days net, to pay the rest.

Doing so ensures that your invoices are paid on time, but still allows you to put your available cash to better use.

-

Keep the Lines of Communication Open

Effectively communicating with your vendors and suppliers can strengthen business relationships.

For example, if you always pay your bills on time, your vendor may be open to giving you better payment terms.

And if you run into financial difficulty, letting your vendor know their payment will be a few days late will be better received than your silence.

-

Automate Manual Processes

If you’re ready to simplify accounts payable, consider implementing one of the many products designed to automate AP processes.

Optical character recognition (OCR) software, artificial intelligence (AI), and machine learning can all be utilized to automate AP while eliminating manual, repetitive tasks.

While automation can benefit even the smallest business, if you have a large number of invoices flowing through AP regularly, you should consider implementing a Procure-to-Pay software solution like Planergy, which incorporates AP automation software and works with your accounting software to automate the AP process from purchase order to payment.

-

Regularly Review Accounts Payable

Even with automation, you should still take the time to review and reconcile AP accounts, which can ward off potential problems before they become serious.

For a more in-depth review of your AP department, consider implementing a yearly accounts payable audit program.