The accounts payable process can be a cost-center or a value-driver, depending on how an organization approaches it. To capture the benefits of the accounts payable process and cut down on labor-intensive costs, automation is key.

In this article, we’ll dive into what the accounts payable process is, how it works, and how automation can help organizations derive value from it.

What Is Accounts Payable?

Accounts payable (AP) is the department in a company that’s responsible for paying for the goods and services that the company purchases.

The AP department’s main focus is to ensure that vendors and creditors get paid in a timely manner while maintaining good cash flow for the company. AP teams generally do not focus on purchasing but on making payments.

The accounts payable cycle includes:

- Receiving and processing invoices from suppliers

- Matching invoices against purchase orders and receipts to ensure they are correct.

- Approving invoices or sending them back to vendors with more questions.

- Making payments via the vendor’s preferred method, whether that be wire, direct deposit, or paper checks.

- Setting up payment plans when necessary and ensuring installments are paid on time.

What Is the Difference Between Accounts Payable and Accounts Receivable?

Accounts payable and accounts receivable sound related and they are, but they are in some ways exact opposite workflows. That’s because one department is responsible for payments going out, and the other is responsible for payments coming in.

Accounts payable is responsible for vendor payments, paying creditors, and paying other organizations that a company purchases goods and services from or owes money to.

Accounts receivable is responsible for inbound payments that the company collects for goods and services they provide, which is in a way the opposite of accounts payable.

In order to not get them confused, just remember that accounts payable (AP) is payments going out, while accounts receivable (AR) is payments coming in. For more on the differences and similarities, read our article on accounts payable vs accounts receivable.

What Is the Accounts Payable Process?

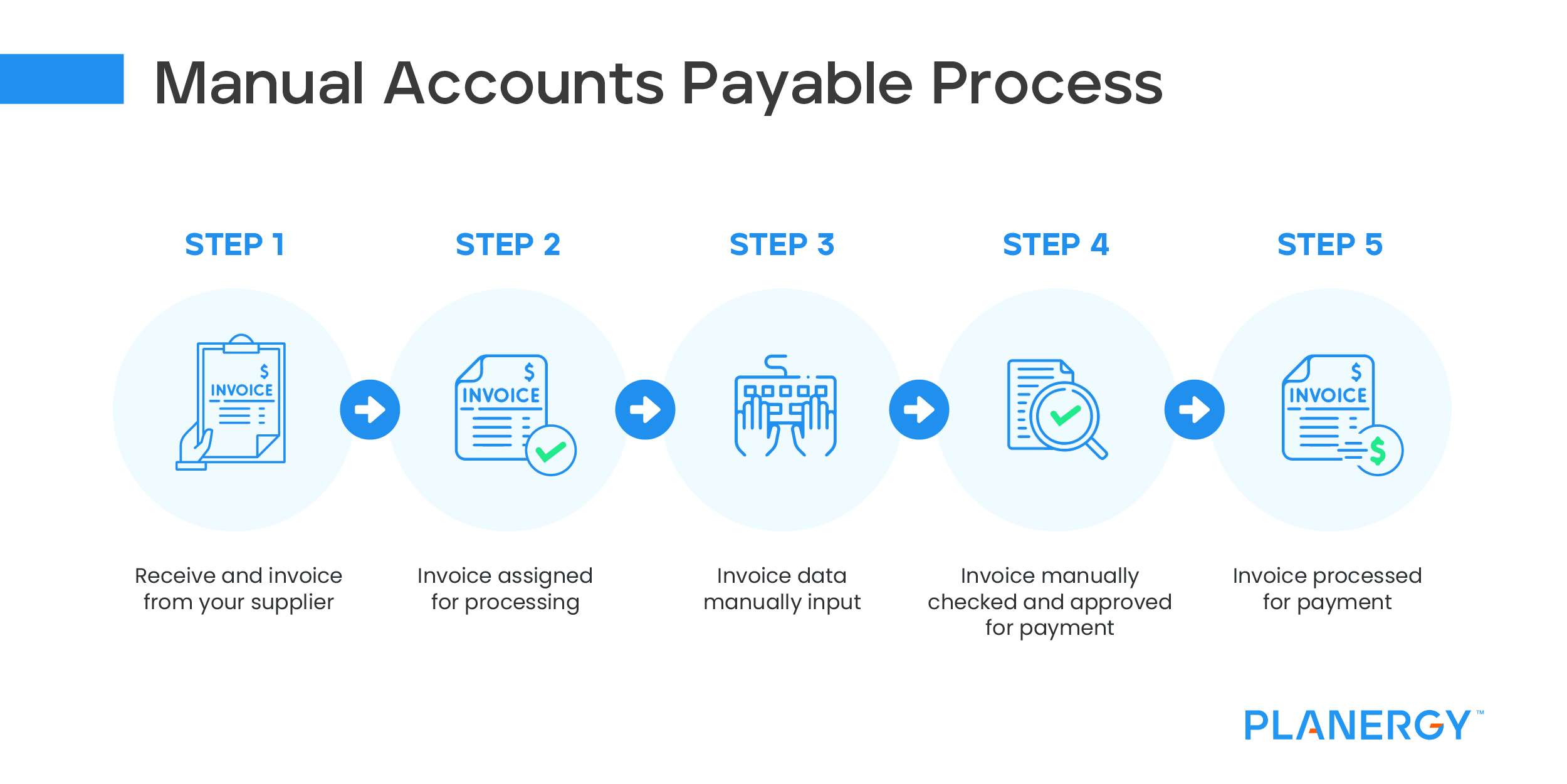

When issuing a payment, the accounts payable team goes through a process to ensure that payments are accurate and made on time. The accounts payable process includes the following steps:

Invoice Is Received

Invoices may arrive in many different forms: fax, email, mail, or through an invoicing software system. Without a process in place, invoices may be delivered to the wrong people, requiring extra work for the invoice to get approved and paid.

Invoice Assigned for Processing

After an invoice is received, it is forwarded to an appropriate person, either a department manager, the company accountant, or an accounts payable specialist. If a company is clear on its purchase order about who should receive the invoice, this step can be avoided.

AP automation software can automatically receive, process, and assign invoices to the right people.

Invoice Entered Into the Accounting System

The invoice data is then typed into the company’s accounting system, and the document may be scanned and saved. This step can also be automated using AP automation software, which can reduce the risk of double-entry.

Invoice Approval Process

The approval process includes verifying that the expense was initially approved by matching with the purchase order (PO), the complete shipment arrived and/or services were provided, and that the invoice is not a duplicate and already paid.

It can be time-consuming to track down all the details for every invoice, but if your AP software integrates with upstream procurement data, as Planergy does, you can automate much of the process. This also helps to ensure payments are made early enough to capture early payment discounts—creating a positive effect on the balance sheet.

Payment

Once a series of vendor invoices are verified and approved, most companies will run a batch of payments. These can be either through paper checks sent in the mail, via ACH direct deposit (in the US only), or through wire transfers.

What Is the 3-Way Match Process in Accounts Payable?

Accounts payable teams use the three-way match process to ensure that they only pay invoices for the correct items and amounts. In 3-way matching, three documents (purchase order, orders receipt/goods receipt note, and invoice) are compared to each other to ensure that the quantity and price are correct.

If all three documents match, then the invoice is paid. If there is a discrepancy, the accounts payable team can send the invoice back to get their questions answered by the supplier.

There are some pros and cons to the 3-way match process. The pros are that it ensures that payments are made only for the correct amount and that it can help accounts payable teams from making duplicate payments. The cons come mostly from doing this process manually.

Manually comparing receipts, purchase orders, and invoices either on paper or through a computer screen can be time-consuming and costly to pull off.

Accounts payable automation software can streamline this process so that all the documents are automatically pulled and compared. Humans can verify that the matches are correct, but the software does the bulk of the tedious work.

What Are the Challenges Facing Accounts Payable?

Just like with 3-way matching, the majority of challenges accounts payable teams face comes from doing things manually. Doing things the hard way costs AP teams a lot of time and money, which can be avoided through software.

Manual processes require AP professionals to manage the tasks by hand—filing paper documents, manual data entry, and matching numbers line by line to ensure the PO matches the invoice and delivery. These are costly and outdated ways to get things done, and they’re prone to human error and lack of oversight.

Manual approval processes with multiple approvers involved can also weigh accounts payable teams down. Waiting on approvers to reply to emails and sign papers becomes a liability for late payments. Even with gentle reminders, the payment process takes so long that AP teams cannot qualify for any early payment discounts that vendors offer (and may incur late fees).

The approval delays are often caused by a lack of visibility of upstream data, an end-to-end AP software that covers 3-way matching ensures approvers can review relevant detail and approve faster. It can also reduce the number of approvers you may want to include, especially when a 3-way match is completed successfully.

On top of that, any increase in volume can overload a manual AP process due to the amount of labor time and detail to complete the work. This results in data entry errors, invoice matching errors, and lost opportunities for early payment discounts.

How Can You Streamline the Accounts Payable Process? The Benefits of Automation.

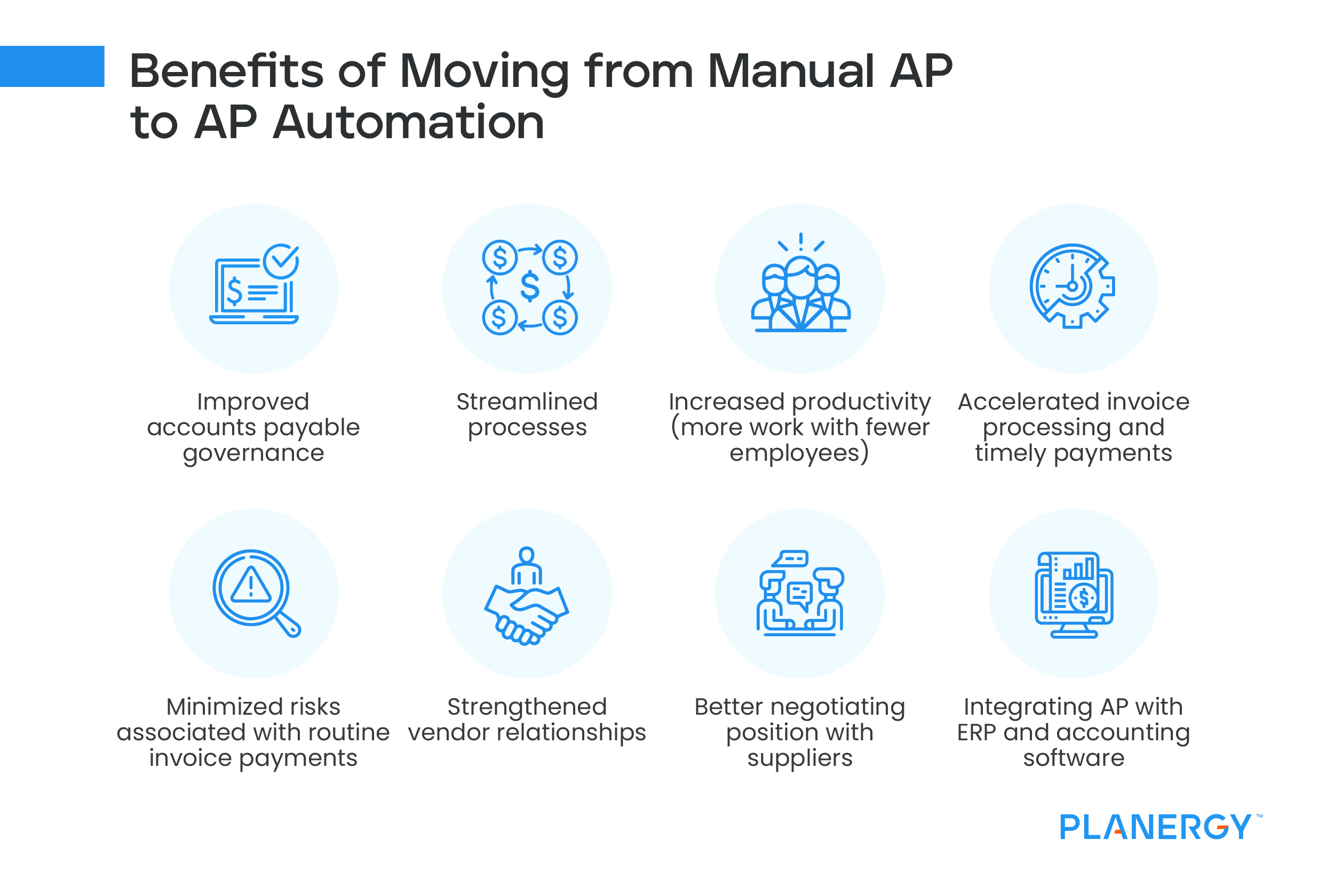

For teams to streamline the accounts payable process, automation is key.

2020 research conducted by Ardent Partners found just 24.2% of invoices were being processed straight through. AP automation improves processing times across the invoice lifecycle by 300%; the attendant gains in speed, accuracy, and transparency translate to invoice processing costs that are six times lower than those relying on manual AP.

With AP automation software, the second an invoice is received is when the automation begins. A program checks each line item against the PO and the receiving information to ensure that the goods and services ordered are the same as the items received and billed. If an error is found, an alert is sent to the accounts payable department for verification.

With a pre-populated list of vendors, items, pricing, and payment terms in the system, the process requires minimal input from start to finish. Automation helps businesses minimize exceptions, improve invoice reconciliations, streamline accruals, and generate accurate, up-to-date financial statements when needed.

The benefits for businesses who switch from manual processes to AP automation are numerous:

- Improved accounts payable governance

- Streamlined processes

- Increased productivity (more work with fewer employees)

- Accelerated invoice processing and timely payments

- Minimized risks associated with routine invoice payments

- Strengthened vendor relationships

- Better negotiating position (due to improved oversight and earlier payments)

- Integrating AP with ERP and accounting software

- Improved collaboration with the procurement and purchasing department

- The ability to assign GL codes and tax rates automatically, which benefits the accounting process as well as payment processing

Following accounts payable best practices with an automated accounts payable system helps businesses stay within budget and maintain cash flow. Spend reporting tools give businesses the power to make informed decisions based on accurate metrics. This can prevent leaks, maverick spending, fraud, and overpayment errors (while ensuring due dates aren’t missed).

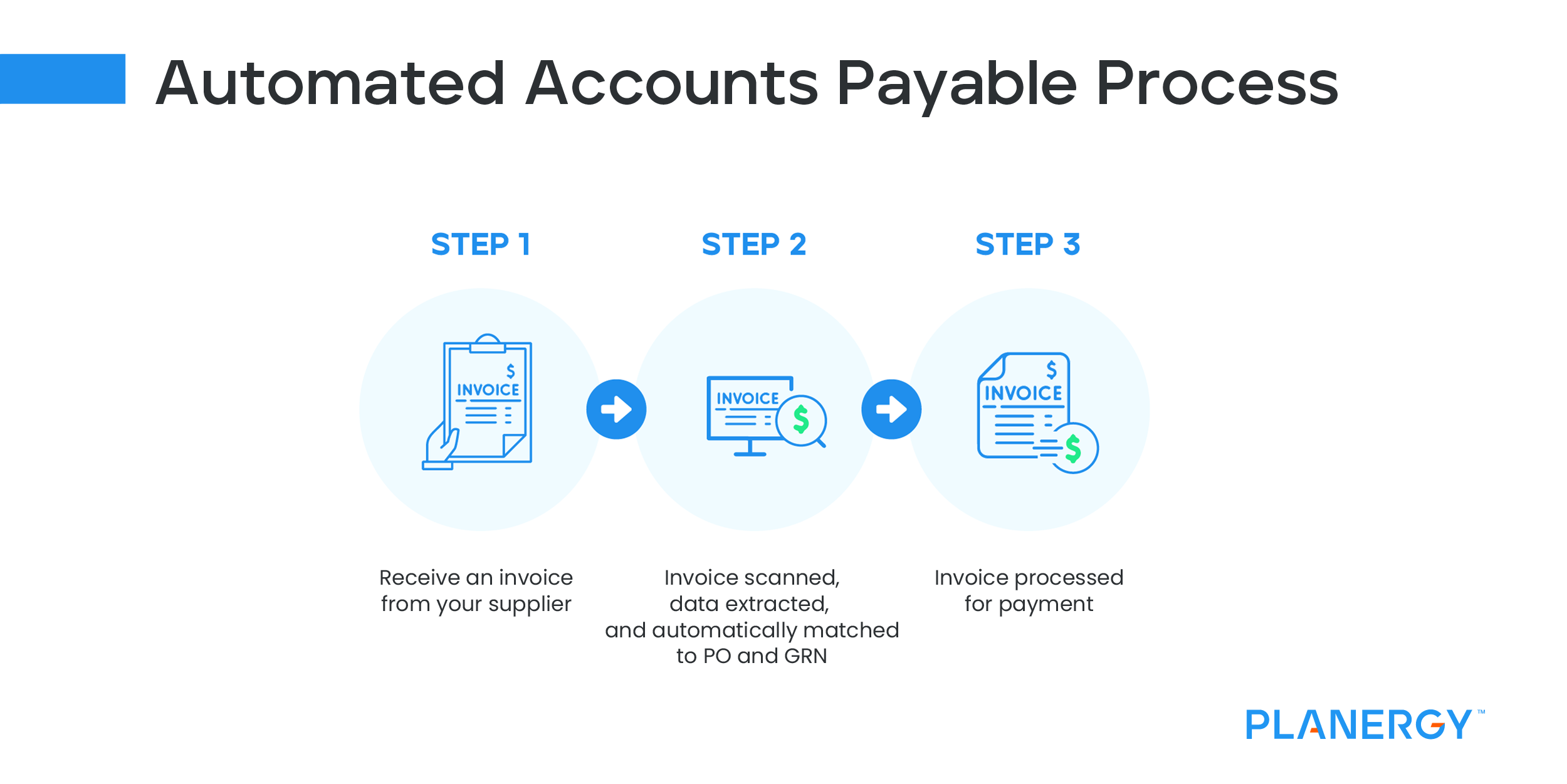

The Automated Accounts Payable Process: Three Steps

Unlike the five-step manual accounts payable process outlined above, the automated process is reduced to just three steps:

Receive an Invoice

Using an AP automation system, invoices can be received digitally and automatically inputted into the system. Alternatively, paper invoices or those emailed outside of the system can be quickly uploaded.

Invoice Data Extraction

Automated systems scan and extract all data from the invoice and instantly match that data against the relevant PO and receiving documents to ensure accurate pricing and quantity.

Invoice processing

Once confirmed for accuracy, invoices are then automatically processed for payment. This process can be reviewed manually or be done completely automatically for smaller payments or payments to trusted suppliers.

The automated accounts payable process drastically reduces the amount of time and money spent on processing invoices. It also ensures higher levels of accuracy and reduces the number of incorrect invoices paid.

With AP automation software, the second an invoice is received is when the automation begins. Invoice processing costs are six times lower in automated AP systems.

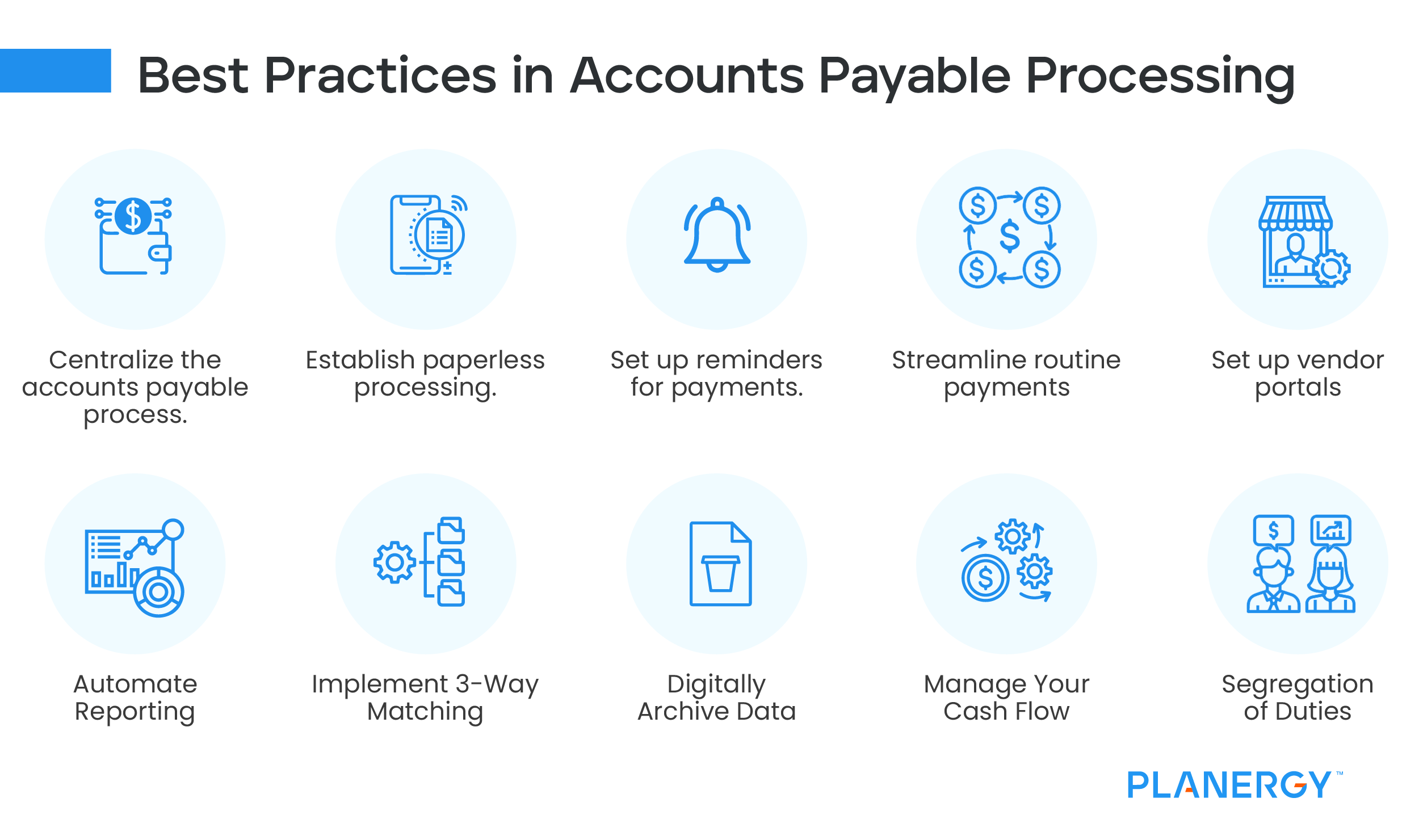

What Are Best Practices in Accounts Payable Processing?

Following best practices in accounts payable can help ensure that bills are paid on time and without incurring unnecessary costs. While every organization requires a customized accounts payable process to meet its unique needs, here are nine general best practices:

Centralize the Accounts Payable Process

All AP data and processes should go through a single system with a shared database. This makes it easier for every department to adhere to protocols, eliminates redundancy, and cuts down on processing time and data entry mistakes.

Establish Paperless Processing

Businesses that switch to automated AP systems from paper-based processes see numerous benefits such as more vendor transparency, more access to discounts, reduced processing time, and fewer errors.

Set up Reminders for Payments

This enables businesses to avoid late or missed payments, take advantage of discounts, and anticipate expenses.

Streamline Routine Payments

Implement accounts payable protocols to categorize and automatically approve certain types of requests made by specified people to streamline the approval process.

Set up Vendor Portals

Vendor portals allow vendors to track the status of deliveries, scheduling, contract terms, and invoicing in your system without the need to talk to a representative (so you save on time and labor costs while improving vendor relations).

Automate Reporting

Organizations should have instant access to real-time accruals, budget, and spend details. In the event of an audit, a budget meeting, or a request from the board, an accounts payable team using an eProcurement program should never have to scramble to produce a detailed report and can even set up scheduled reports.

Implement 3-Way Matching

As covered in an earlier section, 3-way matching ensures that only valid, accurate invoices are paid.

Digitally Archive Data

AP software makes digitally archiving records simple. At every step from PO to payment, documents are attached to the transaction record. Saving this documentation digitally allows teams to assess how well contract terms were fulfilled and when payment was made. It also makes it much easier to find documents and information for internal review or during audits.

Manage Your Cash Flow

Knowing upcoming expenses is critical to maintaining a budget. An automated accounts payable system helps ensure that there are no surprises. Cash flow can be managed by scheduled outgoing payments for when there is enough income to pay them. Build a cash reserve to fill gaps when cash flow slows and bills are due.

Segregation of Duties

No single person should have complete control over a company’s ability to make payments. This isn’t just a risk for fraud, but also a risk for human error, as having just one person responsible for internal controls isn’t a good idea. Separating duties and sharing responsibilities helps make sure that companies only pay for the goods and services they ordered and mitigates fraud risk.

AP Automation Is Part of a Larger Process

Despite its many advantages to manual AP systems, AP automation doesn’t solve every problem. Even in automated systems, there can still be a lack of upstream data to authorize payments and a lack of collaboration with procurement teams.

That’s why taking an end-to-end, full-cycle approach to the AP process, and automating everything from start to finish (not just AP) can be more beneficial. Organizations that include AP automation as part of their entire procure-to-pay process—which includes procurement and purchasing as well as AP—take a better approach to addressing challenges that affect the entire organization, beyond just AP.

The most advanced organizations unite the procurement, purchasing, and AP processes and enjoy the benefits of automation throughout each. Choosing software that can effectively manage each of these processes together is key to getting your organization there.